CAG castigates Mehbooba-led PDP-BJP Govt, Drabu

*Calls for recovery of amount sanctioned in violation of Central scheme

Neeraj Rohmetra

JAMMU, Jan 15: The Comptroller and Auditor General (CAG) has passed serious strictures against previous PDP-BJP coalition Government headed by Muftis especially the Finance Department which was under the control of PDP leader Dr Haseeb Drabu and Jammu and Kashmir Bank for benefits under the Interest Subvention Scheme (ISS) running into several crores in favour of ineligible persons including big industrial houses, houseboat owners etc.

The CAG has called upon the Central Government to review interest subvention and other benefits extended to ineligible persons and firms and recover the amount sanctioned in their favour by the then Government in violation of guidelines of the scheme.

The Central Government had sanctioned Rs 800 crore in November 2015 to meet the challenge of livelihood restoration of industrial and business enterprises affected by the floods of September 2014 in Jammu and Kashmir, The scheme for interest subvention was sanctioned in April 2016 by the Government of India under the PMDP. As per the scheme guidelines, interest subvention was to be restricted only to those units availing credit facility from the Banks for business purposes which were affected by the floods of September 2014.

From March 2015 to July 2018, PDP-BJP Government ruled J&K, first headed by Mufti Sayeed and then Mehbooba Mufti.

“A total of 50081 small traders/business having annual turnover up to Rs 10 lakh identified by the Divisional Commissioner Kashmir on recommendations of the concerned Deputy Commissioners were to be provided financial assistance to the extent of 50 percent of actual losses suffered by them. The Jammu and Kashmir Bank Limited (JKBL) was convener of JKSLBC (State Level Bankers Committee) while the scheme was implemented by the Principal Secretary Finance Department through JKSLBC, JKBL, the Chief Minister’s Secretariat and the Deputy Commissioners of eight districts in the Kashmir division,” the CAG pointed out.

Referring to Chief Minister’s Business Interest Relief Scheme (CMBIRS), the CAG said, under this scheme, the Finance Department released Rs 200 crore including Rs 180 crore of PMDP funds) in favour of the JKSLBC . Out of this, an amount of Rs 199.96 crore had been remitted to 15 banks including Rs 190.20 crore to J&K Bank..

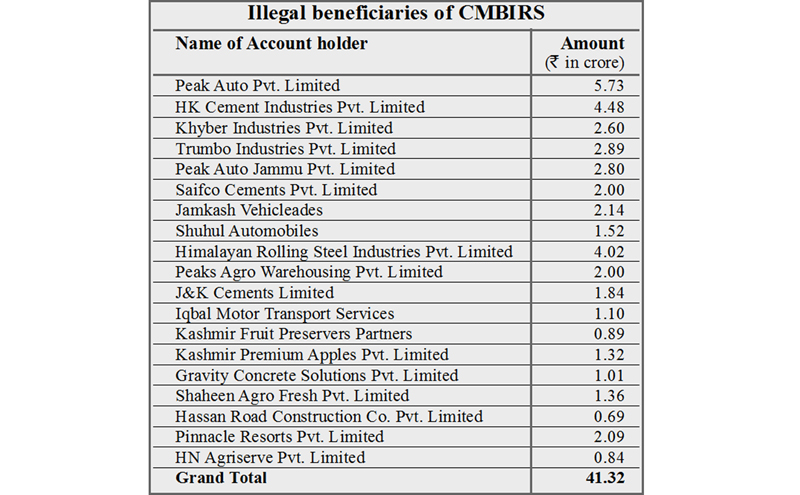

“An amount of Rs 180 crore received from the Government of India was paid to beneficiaries under CMBIRS which was a commitment of J&K Government made during budget session of 2018-19 (the last session of Mehbooba Mufti-led PDP-BJP Government). The payment was not as per guidelines of the Interest Subvention Scheme of the PMDP. Further, out of Rs 190.20 crore to JKBL, Rs 41.32 crore were provided to only 19 borrowers,” the CAG observed and pointed out that out of 19, ten borrowers to whom the benefit of Rs 21.02 crore was given were not at all affected by the floods of September 2014 and had been restructured only after the unrest of 2016 (in the aftermath of Burhan Wani killing) under Special Rehabilitation Package.

The CAG report said the Joint Director (Resources), Finance Department stated that sanction was accorded in March 2018 (PDP-BJP Government rule for roll out of CMBIRS as per announcement made by the then Finance Minister (Dr Haseeb Drabu) in his budget speech 2018-19. The reply confirmed that funds released by the Government of India were diverted by the Government of J&K for its own commitment and not for payment under the scheme of interest subvention, it added.

The CAG disclosed that M/s DP Dhar Memorial Trust was provided financial assistance of 0.55 crore as subvention of 50 percent of interest charged and five percent interest subvention even though there was no provision for release of assistance to a private trust in the Interest Subvention Scheme.

Meanwhile, nine borrowers who were ineligible but got interest subvention from January 1, 2016 to December 31, 2018 are Universal Sales Agency Prop. Tahir Ali ‘Irfan’ Kursoo Raj Bagh, Splendid Developers & Builders, Bilal Ahmad Mir, Mohamad Amien Bhat, Jehlum Roller Flour Mills, Meer Handicrafts Prop.- Bilal Ahmad Mir, Shabir Ahmad Bhat S/o Mohd Subhan Bhat, M/s Posh Pharma Pharmaceuticals Distributors Prop. Ab. Rouf Wani and Noor Fashion Design Prop. Masrat.

The Audit noticed that accounts of nine borrowers which were sub-standard even prior to the floods of September 2014, were subsequently included in the list of 11,449 accounts prepared by the JKBL and provided interest subvention of 50 percent of the interest charged during September 1, 2014 to December 31, 2015 amounting to Rs 16.49 lakh. Further interest subvention of Rs 36.62 lakh was also provided to these borrowers.

“Thus, interest subvention to the extent of Rs 74.57 lakh was provided to 107 accounts of two Banks which were sub-standard prior to floods of September 2014 and were, therefore, ineligible as per the scheme guidelines,” the CAG pointed out.

The JKBL, however, stated interest subvention of Rs 20 lakh released in favour of M/s Jhelum Roller Flour Mill would be recovered and refunded to the Government through the JKSLBC.

In rest of the cases, the JKBL stated that as per the scheme guidelines of Special Rehabilitation/ Revival Package for persons affected by natural calamity (2014 floods), outstanding standard loans as on 31st August 2014 were eligible under the scheme and that eight accounts were standard as on 31st August 2014 and eligible for rehabilitation under the scheme.

“Reply of the JKBL management is not acceptable as nine accounts which were sub-standard as on 30th June 2014 were irregularly included in the list of 11,449 restructured accounts by the JKBL and provided interest subvention,” the CAG observed.

In view of the findings, the CAG has recommended to the Government of Jammu and Kashmir to review all cases where interest subvention has been allowed to ensure only genuine claims are accepted and recovery effected from units not meeting the criteria but have availed the benefit.

The Audit noticed that the Finance Department in January 2018 released Rs 1.47 crore to the Department of Tourism for waiver of loans in respect of 19 houseboat owners who had turned defaulters with Banks for loans taken earlier, as one-time settlement .

“The Director Tourism Kashmir in March 2018 disbursed Rs 1.47 crore to nine banks for settlement of these loans which was not eligible to be covered under the scheme,” the CAG noted. It said these houseboat owners were not affected during September 2014 flood and thus waiver of their loans was a violation of the scheme guidelines.

Significantly, as per the CAG report, the Joint Director (Resources), Finance Department confirmed the audit observation but blamed the then Finance Minister of Jammu and Kashmir Government who proposed one-time waiver of all such loan cases on the pattern of previous budget announcements.

The CAG has directed that this interest subvention for the loans advanced also needs to be recovered.

Further, the JKBL disbursed an amount of Rs 26 crore as interest subvention among 36,891 artisan beneficiaries from July 2016 to February 2017 under the Prime Minister’s Development Package for settlement of outstanding balance of interest on Artisan Credit Cards (ACC).

The CAG, however, stated that the ACC scheme existed prior to announcement of the PMDP and was not eligible for assistance under the Interest Subvention Scheme. Moreover, specific linkage to losses occurred due to flood had not been done.

In this case also, the Joint Director (Resources) Finance Department virtually shifted the blame on the then Finance Minister.

“The Joint Director Resources stated that a policy decision was taken in a meeting on July 2016 held under the chairmanship of the then Finance Minister (Dr Haseeb Drabu) that Rs 26 crore outstanding on account of interest subvention be provided as one time relief to the artisan community as this class was badly affected by September 2014 floods.

“The reply confirmed the audit observation that funds released by the Government of India for the scheme were diverted towards commitment of the Government of J&K for payment of interest subsidy to artisans under the ACC scheme which was not admissible,” the CAG observed.

The Government of J&K also released funds to the tune of Rs 244.78 crore between July 2016 to June 2017 to JKSLBC for disbursement to the banks operating the Kissan Credit Card (KCC) scheme in J&K. Audit observed that sanction of funds by the then J&K Government was in violation of interest subvention scheme guidelines and resulted in diversion of funds worth Rs 244.10 crore as the scheme was not extendable to agricultural production loans.