Anjan Roy

This year’s Nobel prize for economics has been awarded to two academics who have made a great deal of difference to sale of publicly owned resources. If the precepts and formats suggested by the economists are genuinely followed, then many of the political controversies in this country could be avoided.

I am referring to the huge scandals invariably associated with Government’s award of licences for commercialisation of socially owned resources from, coal, oil, natural gas to radio frequencies to landing rights in busy airports.

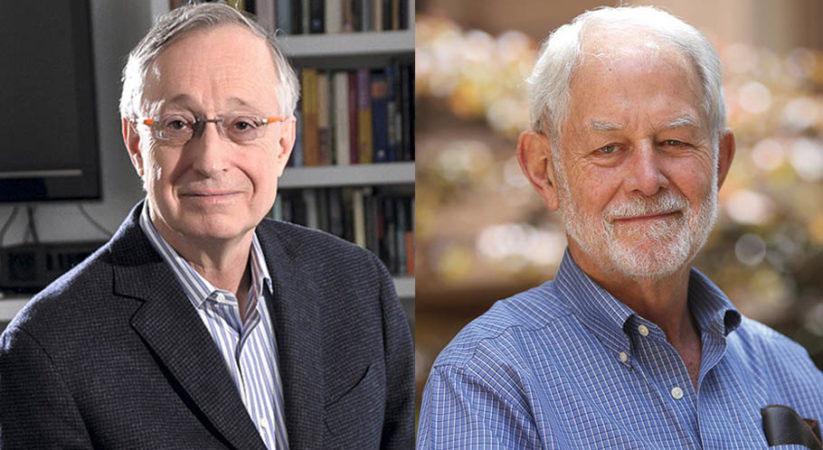

Paul Milgrom and Robert Wilson, both American economists, worked and formulated formats for auctioning which can be used for selling critical assets owned by the community at large to private or even public sector companies for commercial exploitation.

While the commercial users make money on their exploitation, the proper pricing for award of these resources and selection of those who receive permission to use such resources is extremely important. There are two conflicting aspects of this exercise.

First is that since most natural resources are primarily owned by the society as such, the Government as the trustee has to ensure that these scarce resources are utilised for greatest common benefit. That is, the price paid by those who are given right to use must be adequate and reflect the value of the resources handed over. Maximisation o revenues on sale of these resources is therefore just.

Secondly, at the same time, the sale price should not be so prohibitive as to stagnate their development and help the growth process. Very high price can prove to be unviable commercially and therefore stunt growth. Users burdened with too high prices resulting from high Government charges could preclude their wider use.

So award of such contracts for commercial use to private or public layers could be a very complex process inherently. Additionally, the system must also ensure no scope or political interference and discretionary powers for undue gain to those who are in a position to control. We have seen all these adverse consequences in the award of natural resources in this country.

This year’s Nobel Laureates have worked to develop market mechanisms for achieving these conflicting goals and achieving maximum societal benefit. They have devised markets for achieving these objectives.

The beauty of this year’s Nobel winners’ work had been that while they began from a strictly theoretical base, their work subsequently turned into very practical mechanism for conducting fair and free auctions of critical resources. Auction economics has been studied for quiet sometime within the framework of a game theory structure.

IN the 1960s, William Vickrey had started studying what came to be known as auction theory. He studied bidders’ auction strategies and studied the revenue and efficiency implications of different types of auctions in which bidders have no knowledge of the underlying valuations of other bidders.

Robert Wilson, the older of this year’s winners, had picked up from Vickrey and started studying more complex auction scenarios in which bidders have tried to assess the information base of other bidders. For example, a successful bidder might land with an award and discover that others had more precise knowledge of the value of the items being sold. Therefore, they may have bid lower while the successful one placed higher bids to regret later. This had been described as the “winner’s curse”.

There are various other complications as well. Even with the same idea about the value of an asset -say, oil reserves in an acreage auction- the bidding process would be influenced by the cost-efficiency parameters of the bidders. The theoretical studies and analyses of various kinds of complicated systems and considerations underlying the process of bidding and offering of the bids led them to practical aspects of framing markets. One of the economists have even set up a firm to advise firms going for bidding. At the same time, they formulated markets for the regulators to conduct such auctions fairly and freely.

The practical significance of the work can be gauged from the fact that award of publicly owned resources like coal blocks or telecommunications spectrums have raised huge concerns about irregularities.

Several politicians have been accused of handing over these resources cheaply to favoured buyers in consideration of huge pay-offs. Coal block awards had been touched the then Prime Minister’s office during the second UPA regime.

Several politicians and their contacts had to go to spend time in jail as a result of the irregularities in auctioning of natural resources. Later, a senior retired Government official, Ashok Chawla, was charged with preparing a mechanism for free and fair auctioning.

Many of the Indian auctioning models had been devised on the basis of the concepts and techniques propagated in these theoretical exercises.

Milgrom and Wilson had developed models for transparent auctions so that selling such resources should generate maximum amount of earnings for the state, while at the same time optimised their use for public good. Milgrom-Wilson models were first used in the USA for auctioning radio frequencies.

Radio frequencies were the primary material for use of cellular phone service companies. While these companies earned profits on their use, the model format for auction ensured that society benefited out of the process of auctioning. The Federal Communication Commission used these models to auction frequencies in a large number of geographical areas and maximised income.

The earlier system of award by lotteries in the USA resulted in varied prices in different locations and thus militated against a universal national price. The new format permitted simultaneous auctioning in all regions.

The success of the Wilson-Milgrom model in the United States led to its adoption in Britain, Canada and Spain, which also could hold simultaneous national level auctions.

Asked whether he had ever bought anything from an auction himself, Professor Milgorm replied that his wife informed him that they once bought something from an on-line offer of household apparels and shoes. He supposed that was kind of auction. The two economists started with some fundamental theoretical precepts and then evolved practical guidelines for conducting actual auctions. Of the two economists Wilson has been a teacher of a number of Nobel laureates in economics, including his co-winner this time. Milgrom was a research student of Wilson for his thesis. (IPA)