KOLKATA, Dec 9: A special research report from State Bank of India’s Economic Research Department Six months after unlock – authored by Dr Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India, says in November, 2020, average Google Mobility declined in major European countries and US, but it increased in case of Brazil and India.

Our model shows that there is visible shift in trend in late October. Possible mild second wave in Jan-Feb 2021.

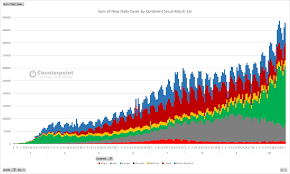

A number of states including Haryana, Gujarat, Madhya Pradesh, Rajasthan, Himachal Pradesh witnessed rising daily new cases in Nov’20

However, certain states including Kerala, West Bengal, Maharashtra, UP, Punjab have lower or almost same number of daily new cases in Nov’20

North Eastern states show reduced daily tests, but new cases still remain higher

The good thing is that in Nov’20 district wise analysis shows that share of top 15 districts and rural districts in new cases almost same as in Oct’20

Our two-stage least square (2-SLS) panel model, where we first regressed the state-wise test data on population to gauge the exact number of tests that should have been done given the population difference across states and then in second stage the cases were regressed on such estimated test numbers arrived from equation 1, has been extended to Nov’20 and it reveals that for India the estimated confirmed cases number is 99.29 lakh which is in fact 4.66 lakh higher than the actual confirmed cases of 94.63 lakh, thus India has done a fairly good job on controlling the spread of the virus

STATE WISE RANKING

We have ranked the states on the basis of performance on three broad categories, Covid management, macro parameters (fiscal and CPI) and performance of states on Central Government Schemes. All the indicators are normalised and then PCA analysis is done to rank the states for each of the three categories

For Covid management, we used four indicators. First is the gap between the actual number of cases and estimated cases based on our 2 SLS results. States with lower number of actual cases compared to estimated cases are considered better than others, Second indicator is the estimated number of underreporting of cases considering peak recovery rate of 78% for each state. Lower the underreported cases the better the state o Recovery rate and death rate are also used for each state. Higher recovery rate and lower death rate are considered better ? In case of Covid management, North East tops the list followed by Bihar and Uttar Pradesh. While, Rajasthan, Maharashtra and Himachal Pradesh are at the bottom ? For Macro indicators, 2 fiscal parameters and state-wise CPI are taken o First, gap between the actual GST collection of states is taken from their budgeted estimate. The lower the gap the better o Second, market borrowing of States so far this fiscal is taken. Higher borrowing is considered worse for a State o CPI inflation is also considered in this and lower inflation rate is taken as better ? In case of macro indicators, North East, Himachal Pradesh and Madhya Pradesh have performed better, While, Bihar, Andhra Pradesh and West Bengal are at the bottom ? For performance in Central Government schemes, state-wise performance is taken for 5 schemes, One nation One Card, PM Svanidhi scheme, PM Kisan Samman Nidhi, Pradhan Mantri Awas Yojana and ECLGS. Ranking of States on the basis of Central Government schemes indicates Uttar Pradesh, Gujarat and Maharashtra are at the top while, Goa, West Bengal and Chhattisgarh are at the bottom ? By combining the scores attained on each of the three parameters, states’ ranking reveals that North Eastern States are at the top, followed by Uttar Pradesh and Madhya Pradesh. Chhattisgarh, West Bengal, and Himachal Pradesh come at the bottom

ECONOMIC MOMENTUM

? The recovery in GDP has been led by manufacturing and the largest component of the services sector – trade, hotels, transport, and communication. This is quite obvious given the movement of freight traffic in Q2 ? During Nov’20, the business activity index shows persistent modest improvement in economic momentum ? In Nov’20, weekly food arrival data shows an increase in the arrival of cereals and vegetables to some extent ? However, pulses and fruits witnessed a decline in arrival after a modest improvement in Oct’20 ? Data consumption in India has witnessed exponential growth over the past few years and in a pandemic. The contribution of 3G and 4G data usage in the total volume of wireless data usage was 4.47% and 94.82%, respectively in Sep’20 ? Nov’20 GST revenue is 1.4% higher than the GST revenues in the same month last year. The positive trend which started from Sep’20 has sustained. State Market borrowings are 46% higher than in the same period last year, indicating the persisting stress in their revenues ? India’s Agri and metal exports have bucked the trend and have stayed upbeat. Pharma exports have also stayed positive. Meanwhile, imports have shown broad-based decline ? Even though Rupee has appreciated recently vis-?-vis US Dollar, it has been displaying weakness against the Chinese Yuan and Euro. Does it indicate the part of a larger strategy? We need to wait and watch! ? India has accumulated huge forex reserves. Excluding gold, now India has the 4th largest foreign currency reserves

CORPORATE DATA SHOWS A JUMP IN REGISTRATION OF FOOD COMPANIES DURING PANDEMIC ? Five states i.e. Maharashtra, Delhi, UP, Karnataka and Telangana accounted for more than 50% of the newly registered companies. In Manufacturing, sectors such as Food, Metal & Chemicals and Machinery and Equipment reported major registrations ? ECB/FCCB loan registration halves as domestic rates soften/tepid demand

BANKING AND FINANCE

? Much of the gloom about National Automated Clearing House / NACH is misplaced. In recent months, the NACH % return (value) of total debits (recurring payments including EMI, insurance premium) has declined. In Oct’20 % return of debits has modestly increased to 32.3% from 31.7% in Sep’20. Also, the per transaction return value has declined to Rs 7495 in Oct’20 compared to Rs 8071 in Apr’20 ? After SC Judgement and following COVID-19 trading volumes in the cryptocurrency have jumped by 85-100%. The average age of investor ranges between 25 and 40 ? In the current FY so far, the banking business is improving with renewed demand from retail segments ? ASCBs incremental credit growth has turned positive in Nov’20 and grew by 0.3% (YTD) as of 06 Nov’20, compared to 0.8% growth during the corresponding period of last year ? Aggregate deposits are also increasing continuously and touched 6.0% YTD growth compared to last year YTD growth of 3.4% ? Digital Transactions are increasing rapidly. UPI is already 1.8X of pre-Covid Levels ? Granger causality results show that a change in % return in total debits causes a change in retail NPA ratio with 1 quarter lag and the result is a significant @5% level of confidence. Regression analysis shows that 1 percentage change in % return (value) leads to 0.46% change in retail NPA ratio ? Commercial paper issuances were almost flat in Nov’20 at Rs 1.21 lakh crore as compared to Rs 1.23 lakh crore in Oct’20. Mutual Funds continue to withdraw from Equity Market ? There has been a modest improvement in credit ratio (upgrade to downgrades) ? After continuous improvement between May’20-Sep’20, our in-house Financial Stability Index shows a modest decline in stability in Oct’20, mainly due to a significant decline in amount issued in the CP market in Nov compared to Oct.

PENDING PAYMENTS TO MSMEs AND DISCOMS HOLDING BACK RECOVERY ? Pending Amount of MSME receivables reveals wide disparity across Ministries and Department reveal Central and State PSUs are the worst culprits ? Discom payments overdue payments show a staggering jump.

(UNI)