NEW DELHI, June 23:

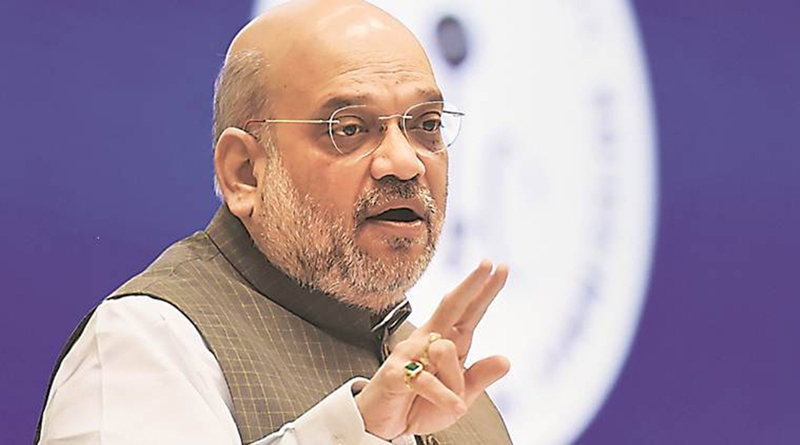

Asserting that urban cooperative banks (UCBs) need to focus on symmetric development, Cooperation Minister Amit Shah on Thursday asked UCBs to undertake key reforms including hiring young talent and adopting modern banking methods in order remain competitive.

Structural changes, strengthening of human resources, computerising accounting process, hiring experts to handle surplus funds are the other reforms that UCBs need to undertake in order to compete with nationalised and private banks, he said.

By implementing these reforms, the UCBs should make themselves more irrelevant in the current times, the minister said and assured that cooperative banks will not be treated like a “second grade citizen”.

“There are 1,534 urban cooperative banks, 54 scheduled urban cooperative banks, 35 multi-state cooperative banks, 580 multi-state cooperative credit societies, 22 state cooperatives. We have a wide presence but it is uneven. … We need to properly work on symmetric development of urban cooperative banks,” Shah said addressing an event here.

Since cooperative banks are the only banks that lend to the lower strata of the society, there is a need to set up at least one UCB in every town in the country, he said and directed the National Federation of Urban Cooperative Banks and Credit Societies (NAFCUS) to focus on symmetric development of UCBs across India.

“Symmetric expansion will help us remain in the competition. Successful banks should also come forward and contribute to this,” he said.

Presently, the role of urban cooperative banks is negligible in the total banking sector in terms of deposit and advance payment, he added.

Asserting that there is huge scope for expansion of UCBs and cooperative credit societies, the Minister said it is because there is increased economic activity in urban centres with 40 per cent urbanisation in the country.

UCBs are necessary for the overall development of the country as these are the only banks that can lend to lower sections of the society. “We need to uplift the lower section and make them part of the country’s economic development. This can be done by cooperatives alone,” he said.

The role of UCBs is such that loans provided by them have helped some set up major businesses in the country, Shah said and shared that he knew at least three such top businessmen who got first Rs 5 lakh loan from urban cooperative banks and they are now major contributors to the country’s GDP.

Listing out the key reforms, the Minister said UCBs cannot be satisfied with the current growth, having Rs 5 lakh deposit and Rs 3 lakh crore advance payment.

“This may appear big, but what is its share in the total banking sector? Urban cooperative banks’ share in deposit is only 3.25 per cent, while in advance payment it is 2.69 per cent. We need to expand this,” he said.

For expansion of UCBs, he said structural changes are required and the next generation having banking experience should be hired for better operation of the banks. The systems should be modernised, accounting should be computerised, accounting alerts should be put in place besides infusing young talent.

Transparency in recruitment and hiring experts to handle surplus funds is necessary, he said.

“Along with cooperative spirit, we need to adopt modern banking methods, then only we will be able to remain in the competition,” he said.

While cooperative banks need to improve their reliability, the Reserve Bank of India (RBI) on the other hand should relax restrictions, he added.

Shah also highlighted that the Government is building a data bank of cooperatives, setting up a separate university for cooperatives, besides framing a new policy.

The minister also felicitated several urban cooperative banks which have completed 100 years of operation.

Minister of state for cooperation B L Verma, National Federation of Urban Cooperative Banks and Credit Societies (NAFCUB) President Jyotindra Mehta and Cooperation Secretary Gyanesh Kumar were present at the event. (PTI)

Trending Now

E-Paper