Excelsior Correspondent

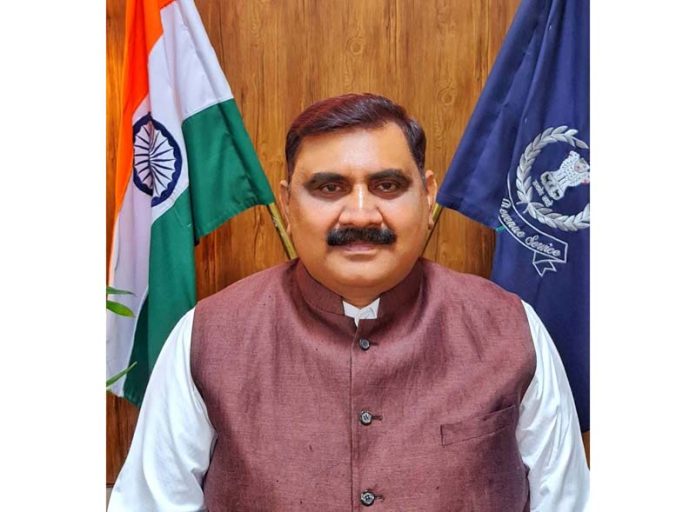

JAMMU, Apr 7: M P Singh, 1990 batch Indian Revenue Service (IRS) officer has been promoted as Chief Commissioner of Income Tax with effect from 01.04.2024 by the Department of Personnel & Training and Central Board of Direct Taxes, New Delhi.

Follow the Daily Excelsior channel on WhatsApp

Singh was posted as Principal Commissioner of Income Tax, J&K and Ladakh for the past two and half years and has given meritorious services to J&K for 10 years as Deputy Commissioner from 1993 to 1999, as Commissioner (Appeals), Jammu from 2018 to 2021 and then as first Principal Commissioner of Income Tax, Srinagar. He is likely to continue as Chief Commissioner of Income Tax, J&K and Ladakh till his superannuation.

He has also served in various capacities in Punjab, Himachal Pradesh, North Bengal/Sikkim, Gujarat and Delhi where he handled Supreme Court matters of Income Tax Department. He was a key person of the department in conducting Parliament elections in Baramula and Budgam districts in 1996 heading more than 250 teams of the department from north-west region and Delhi. Singh is known for taking various social initiatives, outreach programmes for creating awareness for the environment and plantation.

Soon after the assumption of charge of Chief Commissioner, he urged his officers to resolve long pending grievances of the taxpayers of J&K and Ladakh by holding camps in each district and major towns. He has ordered officers to release the bank accounts of small businessmen and salaried persons, in whose case in-fructuous demands have been created during assessments, which had been attached by the department to enforce recovery of outstanding tax demands.

He has urged the taxpayers of the region to keep their accounts in true manner and pay their income tax correctly as the department has full knowledge and data of their turnover and other financial transactions. Singh has also urged the Chartered Accountants and tax professionals of J&K to take initiative and create awareness amongst the taxpayers including salaried persons. They should organize regular seminars and workshops with businessmen and in various institutions like colleges, universities, hospitals, Medical Colleges, Government departments, with police and para military organizations and inculcate sense of financial discipline amongst them besides sharing information on latest tax provisions so that businessmen and salaried people do not get into the trap of touts by claiming wrong deductions or filing inaccurate particulars of income.