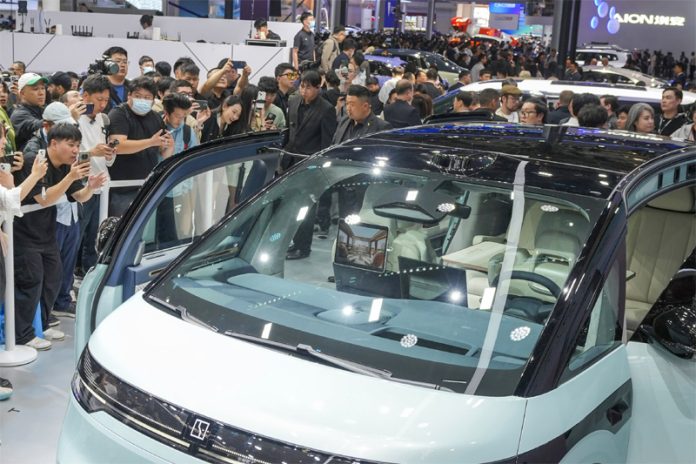

BEIJING, Apr 25 : How about turning a car’s front bucket seats 180 degrees so they face the rear seats and extending out a table so the occupants can play cards or eat a meal? Or a 43-inch (109 centimeter) screen for the passengers in the back seat?

The seemingly never-ending efforts of China’s electric car makers to redefine the automobile went on display on Thursday at the opening of the nation’s largest annual auto show. They are forcing established makers such as Volkswagen and Nissan to change the way they develop cars to remain players in what is the world’s largest auto market.

Nissan joined Toyota in announcing a tie-up at the Beijing Auto Show with a major Chinese technology company as the Japanese makers strive to meet customer demand in China for AI-enabled online connectivity in cars.

The car with a large flat screen was launched last week at a price of 789,000 yuan (USD 109,000) by ZEEKR, a young company that is part of the Geely group, a major Chinese automaker that also owns Volvo. It also presented the vehicle with the swiveling front seats, the ZEEKR Mix, as an intelligent living room on wheels. It will be the company’s fifth model when it goes on sale later this year.

“What was the mass market is now being replaced by new energy,” ZEEKR Vice President Jason Lin told The Associated Press at his company’s space at Beijing’s sprawling exhibition centre. “This is particularly obvious at the auto show this year. The cars you see on the new energy stand are very creative. … But when we go back to the market for fuel cars, it seems that they are all cars from three years ago, five years ago.”

A government green-energy push to encourage the development of the electric vehicle industry has transformed the auto market in China. EV sales reached 25 per cent of new car sales last year, cutting into the market for gasoline-powered vehicles. But it’s not just how the cars are powered. Chinese car makers have expanded on the Tesla model, adding digital features and connectivity that appeal to a younger, tech-savvy car-buying audience.

A proliferation of EV makers, encouraged by tax breaks as well as green-energy subsidies, has prompted a fierce price war that is expected to lead to a shakeout and consolidation of the industry in the coming years. Geely’s ZEEKR division, which delivered its first car less than three years ago, has yet to turn a profit, but Lin said the goal is to break even this year.

Hybrids, which have trailed EVs in China, are expected to be a growing segment going forward. The country’s largest EV maker, BYD, showed off two “dual-mode” plug-in cars that can run either solely on electricity or as hybrids. It also introduced the latest version of a hybrid off-road SUV from its luxury Yangwang brand, including an optional built-in drone system.

“China’s EVs … Have successfully realized the large-scale replacement of traditional fuel cars, and this trend is irreversible,” said Lu Tian, the head of sales for BYD’s Dynasty models, which are named after China’s former imperial dynasties.

Not so fast, said an executive from Chery, a more traditional Chinese maker and a leading exporter. Li Xueyong, a deputy general manager, said the company envisions a future of 40 per cent fuel vehicles, 30 per cent hybrids and 30 per cent electric. The company plans to develop both fuel-powered and new-energy cars, he said.

With competition so fierce at home, many Chinese makers are looking overseas, raising concern in both Europe and the US that cheaper Chinese imports could devastate their auto industries. The EU is weighing whether to impose tariffs on China-made EVs because of the government subsidies that drove the industry’s growth.

In Mexico, Chinese vehicles went from about 2.6 per cent of the market in 2021 to 19.2 per cent in the first quarter of this year. Most of those were gasoline-powered vehicles, as there are few charging stations and the cost of electricity makes it expensive to do so at home.

BYD launched its low-priced Dolphin Mini, sold as the Seagull in China, in Latin American markets this year. The company accounted for 41 per cent of EV sales in Brazil in the first three months of this year.

Chinese makers are starting to build plants overseas. Brazil’s President Luiz Inacio Lula da Silva, who began his political career leading autoworkers’ unions in the 1970s, was personally engaged in negotiations last year that are bringing a BYD factory to Bahia state — on the site of a former Ford plant that closed when the US maker left the country. Two other Chinese automakers including Chery already have factories in Brazil.

In China, foreign makers are accelerating the development of new electric car models with digital connectivity to stay competitive.

“This market has become something of a fitness center for us,” Volkswagen CEO Oliver Blume said Wednesday on the eve of the auto show. “We have to work harder and faster to keep up.”

Other automakers expressed similar sentiments. Japan’s Nissan sent top executives to the Beijing auto show to get a first-hand feel for the pace of change in China, company President Makoto Uchida said.

Nissan signed a memorandum of understanding with Baidu to use the Chinese search engine’s generative AI capabilities in its cars sold in China. Uchida said Nissan needs to meet the needs of Chinese customers at the speed at which the market is changing.

“If we cannot do those two aspects, I think it is very difficult to keep our business in China,” he said.

Tang Daosheng, a senior executive from Chinese tech giant Tencent, joined Toyota’s presentation at the auto show, saying the company would provide big data and cloud computing services for Toyota vehicles and connect its ubiquitous WeChat messaging and e-payment system to them.

Volvo, the Swedish brand bought by Geely, stressed a simpler approach to the digitalisation of its cars. The company said its new EX30 electric SUV uses sustainable fabrics and has an audio system and tablet screen that are easy to operate.

“We believe that technology should be measured by its utility, not just its novelty,” said Xiaolin Yuan, Volvo’s Asia-Pacific head.

The EX30 will sell for 210,000 to 260,000 yuan (USD 29,000 – USD 36,000) in China, the company announced.

American brands at the show included Lincoln, Cadillac, Buick and Chevrolet. Ford presented a muscular look tied to its history, telling the story of the Mustang and Bronco — which it described as a “sport utility vehicle” when it was launched in 1966 — and showing the latest versions of those models. (AP)