MUMBAI, June 7: The RBI has revised the GDP forecast for the current FY 24-25 to 7.2 per cent from 7 per cent earlier, and the CPI inflation is projected at 4.5 per cent.

Click here to connect with us on WhatsApp

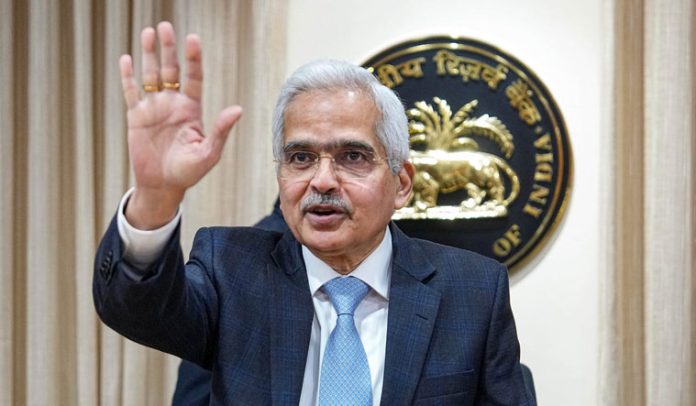

Announcing the policy rates and GDP forecasts on Friday, RBI Governor Shaktikanta Das said, “The real GDP growth for the current financial year 2024-25 is projected at 7.2 per cent with Q1 at 7.3 per cent, Q2 at 7.2 per cent, Q3 at 7.3 per cent, and Q4 at 7.2 per cent. The risks are evenly balanced.”

On the Inflation the RBI Governor added that “Assuming a normal monsoon, CPI inflation for 2024-25 is projected at 4.5 per cent with Q1 at 4.9 per cent, Q2 at 3.8 per cent, Q3 at 4.6 per cent and Q4 at 4.5 per cent, the risks are evenly balanced. The GDP growth projection, we have increased it from 7 per cent to 7.2 per cent and the inflation projection, the average for the year, we have retained it at 4.5 per cent as it was in the last MPC meeting.

Das reiterated the MPC’s commitment to withdrawing accommodation gradually to ensure that inflation aligns with the targeted range while supporting economic growth.

“Monetary policy must continue to remain disinflationary and be resolute in its commitment to aligning inflation to the target of 4 per cent on a durable basis sustain price stability outset strong foundation,” the RBI Governor said.

The decision to keep the Repo Rate unchanged signals the RBI’s cautious approach towards balancing the objectives of controlling inflation and supporting economic recovery.

The food inflation is still above the normal limit and continuously posing challenge to the deflation process of RBI.

The RBI in its Monetary Policy Committee (MPC) has decided to keep the policy repo rate unchanged at 6.5 per cent as retail inflation continues to be above its target of 4 per cent.

The MPC, in a majority decision with four out of six members in agreement, opted to keep the Repo Rate unchanged.

Consequently, the standing deposit facility (SDF) rate remains at 6.25 per cent, while the marginal standing facility (MSF) rate and the bank rate remain at 6.75 per cent.

Governor Das, in his post-policy press conference, emphasised the importance of a balanced approach towards monetary policy.

Highlights of RBI’s bi-monthly policy statement

* Key interest rate (repo) remains unchanged at 6.5 pc

* Repo rate was last hiked in February 2023

* Focus on withdrawal of accommodative monetary policy stance to bring down inflation

* Growth projection for FY25 raised to 7.2 pc from 7 pc

* Inflation forecast for FY25 retained at 4.5 pc

* Food inflation still remains a concern

* The current account deficit for FY25 expected to remain well within the sustainable level

* Foreign exchange reserves touched a fresh high of USD 651.5 billion as on May 31, 2024

* Bulk deposit threshold raised to Rs 3 crore from Rs 2 crore

* Export and import regulations under the Foreign Exchange Management Act (FEMA) to be rationalised

* RBI to set up Digital Payments Intelligence Platform to harness advanced technologies to mitigate payment fraud risks

* Auto replenishment of balance Fastag, NCMC, and UPI-Lite wallets brought under the e-mandate framework

* The next monetary policy announcement on August 8. (Agencies)