NEW DELHI, Dec 13: The Interpol has issued a Red Corner notice against absconding billionaire Mehul Choksi, who is accused of cheating state-run Punjab National Bank to the tune of Rs 13,000 crore in alleged collusion with his nephew Nirav Modi, officials said Thursday.

The international police cooperation agency has issued the notice against Choksi Wednesday on the request of the CBI rejecting his contentions of being persecuted by Indian agencies and the case being political in nature, they said.

A Red Corner Notice is a kind of international arrest warrant where Lyon-based Interpol asks its member countries to arrest or detain a fugitive, wanted by another member country, if he is detected in their respective jurisdictions.

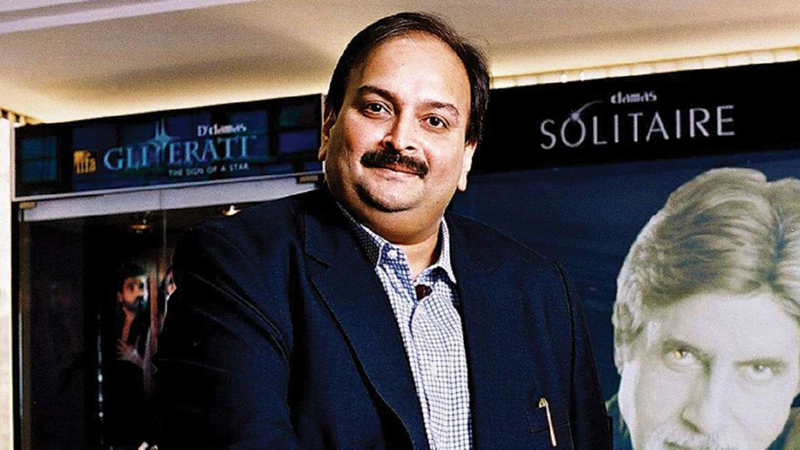

Choksi, 59, Managing Director of Gitanjali Gems Ltd, who escaped in January this year along with his nephew Nirav Modi, his wife Ami Modi and brother Nishal Modi, has taken citizenship of Antigua.

“The Interpol has issued a Red Corner Notice against Mehul Choksi on the request of the CBI,” CBI spokesperson Abhishek Dayal said.

Choksi had challenged the CBI application seeking issuance of Red Corner Notice against him calling the case a result of political conspiracy, sources said.

He also raised questions on issues such as jail conditions in India, his personal safety and health, they said.

The matter went to a five-member Interpol committee’s court, called Commission for Control of Files which cleared the RCN rejecting his contentions, the sources said.

The CBI has charge-sheeted both Nirav Modi and Choksi separately in the scam.

The Central Bureau of Investigation, in its charge-sheets, had alleged Choksi swindled Rs 7,080.86 crore, making it the country’s biggest banking scam at over Rs 13,000 crore.

Nirav Modi allegedly siphoned Rs 6,000 crore.

An additional loan default of over Rs 5,000 crore to Choksi’s companies is also a matter of probe under the CBI.

It is alleged that Nirav Modi and Choksi through their companies availed credit from overseas branches of Indian banks using guarantees given through fraudulent LoUs and letters of credit which were not repaid bringing the liability on the state-run bank, officials said.

An LoU is a guarantee given by an issuing bank to Indian banks having branches abroad to grant short-term credit to the applicant.

The instructions for transferring funds were allegedly issued by a bank employee, Gokulnath Shetty, using an international messaging system for banking called SWIFT platform and without making their subsequent entries in the PNB’s internal banking software, thus bypassing scrutiny in the bank, the officials said. (PTI)