No tax on Rs 5 lakh income, Rs 6000 cash for small farmers

* Workers to get Rs 3000 pension

* Defence budget pegged at Rs 3.05 lakh cr

NEW DELHI, Feb 1: Making a big populist push in its final budget before elections, the Narendra Modi-Government today exempted people with an earning of up to Rs 5 lakh from payment of income tax, announced an annual cash dole-out of Rs 6,000 to small farmers and provided a monthly pension of Rs 3,000 to workers in the unorganised sector.

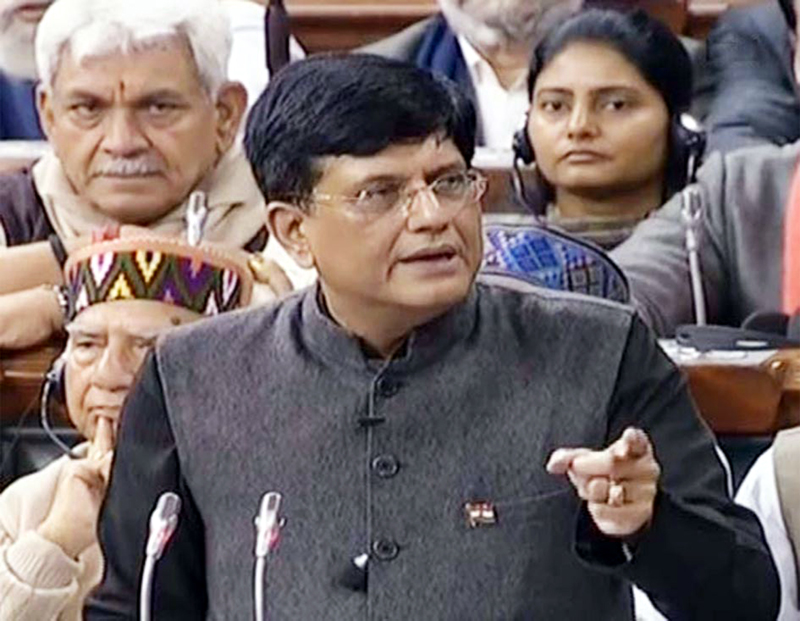

Converting what was supposed to be an interim budget or a vote on account into an almost full-fledged budget announcement in the Lok Sabha, Finance Minister Piyush Goyal proposed an array of incentives for both middle-class and farmers, whose disenchantment was said to have cost the BJP dearly in recent Assembly elections.

Click here to watch video

Over 3 crore salaried class, pensioners, self-employed and small businesses with total income of up to Rs 5 lakh will have to pay nil tax now against their current liability of Rs 13,000 (including health and education cess) in view of the relief Goyal provided in form of a ‘rebate’. Individuals with gross income up to Rs 6.5 lakh will not need to pay any tax now, if they make tax saving investments of Rs 1.5 lakh under Section 80C of the Income Tax Act.

However, very senior citizens (aged 80 years and above) are not impacted by this change as their total income up to Rs 5 lakh was anyway not subject to tax.

The rebate will cost the Government Rs 18,500 crore in revenue.

At a post budget press conference, Goyal promised to look into giving relief to taxpayers with an income of over Rs 5 lakh in the main budget to be presented in July.

At a post budget press conference, Goyal promised to look into giving relief to taxpayers with an income of over Rs 5 lakh in the main budget to be presented in July.

In the Budget for 2019-20, he also raised standard deduction by Rs 10,000 to Rs 50,000 which will provide a benefit ranging from Rs 2,080 to Rs 3,588 depending on income levels.

Other proposals include increase in the TDS exemption limit from Rs 10,000 to Rs 40,000 for bank interest, on rental income from Rs 1.8 lakh to Rs 2.4 lakh, extending housing income exemption from one to two self-occupied houses, capital gains from sale of house property being allowed to be invested in two properties instead of one and the 10-year window for registration of affordable housing projects for getting tax relief.

As was widely anticipated, Goyal announced an income support scheme for 12 crore small and marginal farmers by providing Rs 6,000 in their bank accounts in three equal installments in a year, which will cost Rs 75,000 crore a year to the Government.

The eligibility for the scheme, called Pradhan Mantri Kisan Samman Nidhi, will be ownership of less than two hectares of cultivable land.

Though the Finance Minister said the scheme will be implemented from the current fiscal year, where it will cost Rs 20,000 crore, it wasn’t clear how the beneficiaries would be identified.

The farm income support scheme will result in the government breaching its 3.3 per cent fiscal deficit target from the current year and slipping on 3.1 per cent target for the next. Fiscal deficit for both the years has been put at 3.4 per cent of the GDP.

Wooing farmers, an interest subvention of 2 per cent to those pursuing animal husbandry and fisheries and to farmers hit by natural calamities was announced in the Budget. An additional 3 per cent interest subvention will be given to farmers for timely repayment of loans.

The relief in income tax for the middle class came in form of a rebate. A rebate is different from a general exemption which would have meant income up to Rs 5 lakh for all would have been exempt from taxes and taxes would have to be paid only on income in excess of that.

For anyone earning more than Rs 5 lakh annually will continue to pay taxes at the prevailing rates – no tax on first Rs 2.5 lakh, 5 per cent on income between Rs 2.5 and 5 lakh, 20 per cent on income between Rs 5 lakh and Rs 10 lakh and 30 per cent on earnings of over Rs 10 lakh.

Justifying inclusion of tax proposals in an interim budget which normally is only to seek approval of Parliament for spending for an interim period until a new Government is sworn in, Goyal said, “Though as per convention, the main tax proposals will be presented in regular budget, small taxpayers especially middle class, salary earners, pensioners and senior citizens need certainty in their minds at the beginning of the year about their taxes.”

“Therefore, proposals, particularly relating to such class of persons should not wait.”

The NDA Government, he said, has laid the foundation for India’s growth and development for times to come. India is poised to become a USD 5 trillion economy in the next five years.

Goyal announced a new scheme to provide unorganised workers with up to Rs 15,000 monthly income an assured pension of Rs 3,000 per month after 60 years of age.

The plan is expected to provide social security to 10 crore labourers.

This will attract matching contribution of Rs 100 per month from Government as well as from workers.

Piyush Goyal said, “Half of India’s GDP comes from the sweat and toil of 42 crore workers in the unorganised sector working as street vendors, rickshaw pullers, construction workers… and in numerous other similar occupations. Domestic workers are also engaged in big numbers. We must provide them comprehensive social security coverage for their old age”.

The Government proposes to launch a mega pension yojana namely ‘Pradhan Mantri Shram-Yogi Maandhan’ (PMSYM) for the unorganised sector workers with monthly income up to Rs 15,000, he said.

He further explained that this pension scheme will provide them (informal sector workers) an assured monthly pension of Rs 3,000 from the age of 60 years on a monthly contribution of a small affordable amount during their working age.

According to the scheme, an unorganised sector worker joining the pension scheme at the age of 29 years will have to contribute only Rs 100 per month till the age of 60 years.

The scheme provides that an informal sector worker joining the scheme at 18 years, will have to contribute Rs 55 per month. The Government will deposit equal matching share in the pension account of the worker every month.

The Minister informed that it is expected that at least 10 crore labourers and workers in the unorganised sector will avail the benefit of ‘Pradhan Mantri Shram-Yogi Maandhan’ within next five years, making it one of the largest pension schemes of the world.

The Government has provided Rs 500 crore for the scheme and assured that additional funds will be allocated as needed. The scheme will also be implemented from the current year.

About the gratuity, the Minister said the ceiling of payment of tax free gratuity has been enhanced from Rs 10 lakhs to Rs 20 lakhs (last year in March). All those employee who serve for more than five years are eligible for payment of gratuity on leaving the job or at the time of retirement.

Listing other achievement of the Government, he said,”The New Pension Scheme (NPS) has been liberalised. Keeping the contribution of the employee at 10 pe cent, we have increased the Government contribution by 4 per cent making it 14 per cent”.

Maximum ceiling of the bonus given to the labourers has been increased from Rs 3,500 per month to Rs 7,000 per month and the maximum ceiling of the pay has been increased from Rs 10,000 per month to Rs 21,000 per month, he said.

During the last five years the minimum wages of labourers of the all categories have been increased by 42 per cent, which is the highest ever. The ceiling of ESI’s eligibility cover has been increased from Rs 15,000 per month to Rs 21,000 per month.

Minimum pension for every labourer has been fixed at Rs 1,000 per month. In the event of death of a labourer during service, the amount to be paid by the EPFO has been enhanced from Rs 2.5 lakh to Rs 6 lakh. Under Anganwadi and Asha Yojana honorarium has been enhanced by about 50 per cent for all categories of workers, the minister informed the House.

About job creation, he said, high growth and formalistation of the economy has led to the expansion of employment opportunities as shown in EPFO membership, which has increased by nearly 2 crore in two years reflecting formalisation of the economy and job creations.

An outlay of Rs 3.05 lakh crore has been set aside for the defence budget for 2019-20 which was a hike of around Rs 20,000 crore compared to allocation of Rs 2.85 lakh crore in the current fiscal.

Goyal said additional funds, if necessary, would be provided to secure the country’s borders and maintain defence preparedness.

“Our defence budget will be crossing Rs 3,00,000 crore for the first time in 2019-20. For securing our borders and to maintain preparedness of the highest order, if necessary, additional funds would be provided,” he said.

Referring to strengthening defence and national security, Goyal said the soldiers protect India’s borders in tough conditions and that due care has been taken for them.

He said the issue of One Rank One Pension (OROP) which was pending for the last 40 years has been resolved.

“The previous Governments announced it in three budgets but sanctioned a mere Rs 500 crore in 2014-15 interim budget. In contrast we have already disbursed over Rs 35,000 crore after implementing the scheme in its true spirit,” he said.

He said the Government also announced substantial hike in the Military Service Pay (MSP) of all service personnel and special allowances were given to naval and air force personnel deployed in high risk duties.

Goyal announced a capital expenditure allocation of Rs 1.58 lakh crore for the railways, the highest ever for the national transporter, in an effort to put its flagging revenues back on track.

Goyal, who is also the Railway minister, said so far, 2018-2019 has been the safest for the Indian Railways and all unmanned level crossings on the broad gauge network have been completely eliminated.

“Capital expenditure programme of railways at all-time high of Rs 1.58 lakh crore in next financial year. Vande Bharat Express, indigenously developed semi-high speed (train), will give Indian passengers world class experience.

“This major leap in wholly developed technology by our engineers will give an impetus to the Make in India programme and create jobs,” he said in his debut budget speech.

Goyal also announced that the operating ratio for the current fiscal has improved to 96.2 per cent, and in the next financial year the aim will be to have it at 95 per cent.

No railway fare hike was announced in the Railway Budget for 2019. Lok Sabha elections are slated to be held in April-May.

The planned expenditure would be a 148 per cent hike from the levels of 2014. (PTI)

Highlights

l Income up to Rs 5 lakh exempted from income tax

l Standard Deduction raised to Rs 50,000 from Rs 40,000

l Direct tax proposals to provide Rs 23,000 cr relief to 3 cr taxpayers

l Persons with gross income up to Rs 6.50 lakh not required to pay any income tax if they make investments in provident funds, specified savings and insurance.

l 12 crore small, marginal farmers to be provided assured yearly income of Rs 6,000 under PM-KISAN scheme.

l TDS threshold raised to Rs 40,000 from Rs 10,000 on interest earned on bank/post office deposits.

l Tax exempted on notional rent on a second self-occupied house

l TDS threshold for deduction of tax on rent to be increased to Rs 2.40 lakh from Rs 1.80 lakh

l Tax benefits for affordable housing extended till March 31, 2020

l Tax exemption period on notional rent on unsold inventories extended to two years from one year

l Allocated Rs 20,000 crore in 2018-19, Rs 75,000 crore for FY2019-20 for PM-KISAN scheme

l Interest subvention of 2 pc during disaster to be provided to farmers for the entire period of reschedulement of loan

l 2 pc interest subvention to farmers for animal husbandry and fisheries activities; additional 3 pc in case of timely repayment

l Rs 3,000/month pension for 10 cr unorganised sector workers with contribution of Rs 100/55 per month under PM Shram Yogi Maandhan scheme

l Fiscal deficit pegged at 3.4 pc of GDP for 2019-20; target of 3 pc of fiscal deficit to be achieved by 2020-21

l Current Account Deficit pegged at 2.5 pc of GDP for FY20

l Total expenditure to rise by 13 pc to Rs 27.84 lakh cr in FY20

l National Education Mission allocation increased by about 20 pc to Rs 38,572 cr

l Allocation for Integrated Child Development Scheme increased by over 18 pc to Rs 27,584 cr

l Disinvestment target of Rs 80,000 cr in 2018-19 likely to be met; Target for FY20 set at Rs 90,000 cr

l 25 pc additional seats in educational institutions to meet the 10 per cent reservation for the poor

l Defence budget to cross Rs 3,00,000 cr for the first time

l Allocation for North East increased by 21 pc to Rs 58,166 cr in FY20

l Railways to get capital support of Rs 64,587 cr in FY20

l Indian filmmakers to get access to single window clearance for ease of shooting films; regulatory norms to rely more on self-declaration

l 2 interest subsidy for MSMEs on an incremental loan of Rs 1 crore for GST-registered entities

l At least 3 pc of the 25 pc sourcing for the government undertakings to be from women-owned SMEs

l One lakh villages to be transformed into digital ones in 5 years

l New portal to support national programme on Artificial Intelligence

l Reforms in stamp duty; amendments to ensure streamlined system for levy of stamp duties to be imposed and collected at one place

l A separate Department of Fisheries to be created for welfare of 1.5 crore fisherman

l 22nd AIIMS to be setup in Haryana

l Rs 60,000 crore allocation for MGNREGA in 2019-20

l India poised to become USD 5 trillion economy in next 5 years; aspires to become USD 10 trillion in the subsequent 8 years. (PTI)