NEW DELHI, Dec 25: The Indian cement industry, witnessing a consolidation and heightened rivalry between two corporate houses snapping smaller players, pins its hope on 2025 for an improvement in sales realisation, higher margins and acceleration in demand, expecting around 8 per cent sales growth helped by an increased government spendings on big-ticket infra projects.

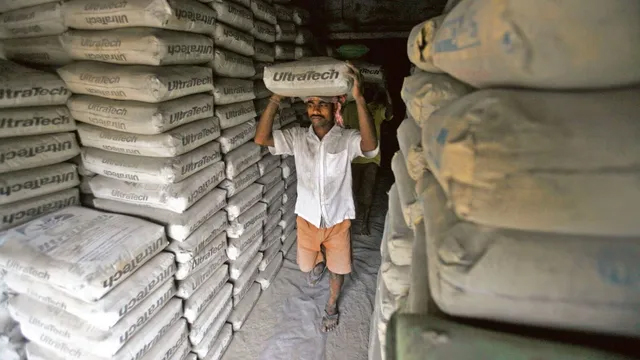

Over 50 MTPA (million tonnes per annum) capacity are being acquired for USD 4.5 billion by two leading players – Aditya Birla group firm UltraTech Cement and billionaire Gautam Adani-led Ambuja Cements, besides organic expansion of the existing units as they have kept their war chest ready prowling for opportunities.

The industry faced challenges on numerous fronts in 2024, right from moderate capacity utilisation to lower sales realisation, which impacted the topline of several makers, contraction of margins and slower volume growth.

However, 2024 would also be known for big-ticket acquisitions by UltraTech and Adani Cement to consolidate their positions and achieve their targeted growth ahead of time.

Adani Cements, a lateral entrant in the secto,r completed the acquisition of Saurashtra-based Sanghi Industries, Penna Industries and recently announced to acquire CK Birla group firm Orient Cement as part of its inorganic growth strategy.

Besides, it has also snapped up small players facilities as My Home and its subsidiary ACC has also acquired Asian Concretes and Cements.

These acquisitions and expansions helped Adani Cement to cross a 100 MTPA capacity with a pan-India presence in 2024 within two years of entry in the sector, with 70 MTPA acquired capacity from Swiss firm Holcim.

The Adani group has plans in the works to raise this to 140 MTPA by FY28, just a shade below market leader UltraTech’s current capacity of 156.66 MTPA grey cement.

Aditya Birla group is also firing on all cylinders to maintain its lead, and has plans for 200 MTPA capacity by FY27. In 2024 it announced acquisition of South-based India Cements Ltd and is in the process of acquiring Kesoram Industries’ Cement Business.

According to Deloitte India Partner Rakesh Surana, 2024 was a year of consolidation for the cement industry, marked by significant mergers and acquisitions.

“This trend has highlighted a structural shift in the sector, with the largest companies accounting for a substantial share of the overall capacity. Currently, the top five cement producers collectively command an estimated 60-65 per cent of the industry’s capacity,” he said.

EY-Parthenon Partner – energy practice Vinayak Vipul said the Indian cement industry has witnessed muted volume growth of 4 to 5 per cent in FY25, compared to over 10 per cent in the past three years, driven by the impact of elections and an extended monsoon across the country.

“With utilisation levels below 70 per cent, net price realisations dropped by up to 10 per year-on-year (YoY) in H1, resulting in an overall decline in revenues and a 200-bps reduction in profitability,” he said.

The industry is adding 35 MTPA capacity in anticipation of increased government spending on housing and infrastructure, with consistent growth of 7-8 per cent expected in the short to medium term, Vipul added.

According to industry body Cement Manufacturers’ Association (CMA) data, India has installed a cement capacity of 690 Metric Tonnes (MT).

Shree Cement Managing Director Neeraj Akhoury said, the Indian cement industry is also on the cusp of a significant transformation, driven by strong demand expected from the infrastructure and housing sectors, coupled with an increasing focus on sustainability and innovations.

“We are confident that improving price realisations and better capacity utilization will drive the industry’s recovery and growth. Additionally, the increase in capital expenditure, both from the government and the private players will provide the necessary impetus to India’s growth story,” said Akhoury, who is also president of CMA.

In 2024, growth for cement decelerated to 4.5-5.5 per cent in 2024 on a high base, following three consecutive years of strong growth, as construction activity slowed in the second and third quarters due to a prolonged heatwave, labour shortages during the general elections period and seasonal weakness during monsoon, said CRISIL Market Intelligence and Analytics Director- Research Sehul Bhatt.

“As a result of the slowdown in demand and continued capacity additions, prices declined by 7 per cent,” he said.

The all-India average cement price was around Rs 348 per 50-kg bag in June 2024. It further decreased by 11 per cent YoY to Rs 330 per bag in September, though it increased by 2 per cent on a month-on-month basis.

In the first half of FY25, cement prices declined by 10 per cent YoY to Rs 330 per bag. A year before, the average prices stood at Rs 365 per bag in FY24 and Rs 375 per bag in FY’23, according to an ICRA report

“The cement volumes are expected to pick up in H2FY2025 backed by likely increase in rural consumption aided by improved farm cash flows, sustained healthy demand for urban housing and expected increase in Government spending on infrastructure projects,” said ICRA AVP & Sector Head – Corporate Ratings Tushar Bharambe.

Consequently, ICRA anticipates the all-India cement volumes to grow by 4-5 per cent YoY to 445-450 million MT in the full year FY2025, he added.

“In the FY2025-FY2026 period, the cement industry is estimated to add around 70-75 MT grinding capacity. Due to this, the capacity utilization is estimated to remain moderate at 70 per cent in the FY2025-FY2026 period despite healthy expected growth in demand,” Bharambe said. (PTI)

Trending Now

E-Paper