Defence budget at Rs 6.22 lakh cr, MHA gets Rs 2.19 lakh cr

*Gold, silver, imported mobiles, cancer drugs to become cheaper

*Rs 3 lakh cr for schemes benefitting women, girls

*Govt brings 3 schemes via EPFO to boost employment

* Internship opportunities to 1 cr youth over 5 years

NEW DELHI, July 23:

Finance Minister Nirmala Sitharaman on Tuesday announced a marginal income tax relief for the middle class, a Rs 2 lakh crore outlay for job creation schemes over the next five years and a spending splurge for States run by parties that are needed to keep BJP in power as she unveiled Modi 3.0 Government’s first budget after the general elections.

With rural distress and unemployment being blamed for BJP losing its majority in Lok Sabha, forcing it to rely on partners to form government, Sitharaman in her seventh straight budget provided Rs 2.66 lakh crore for rural development and maintained spending on long-term infrastructure projects at Rs 11.11 lakh crore to boost economic growth.

She scrapped the ‘angel tax’ that was imposed on investors pumping money into startups, cut import duty on mobile phones and key parts to benefit firms like Apple, slashed customs duty on gold and silver to curb smuggling, and made significant changes in capital gains tax. She, however, raised the securities transaction tax (STT) on futures and options of securities, which disappointed the markets.

Follow the Daily Excelsior channel on WhatsApp

“India’s economic growth continues to be the shining exception (in a world that is gripped by policy uncertainties) and will remain so in the years ahead,” she said. “In this budget, we particularly focus on employment, skilling, MSMEs, and the middle class.”

The centrepiece of the over Rs 48 lakh crore budget are employment, internship and skilling schemes, aimed at creating job avenues for the largest youth population in the world.

Besides Rs 2 lakh crore provided over a five year period for schemes and initiatives to facilitate employment, skilling and other opportunities for 4.1 crore youth, “I have made a provision of Rs 1.48 lakh crore for education, employment and skilling,” she said.

For Bihar, where Assembly elections are due next year, the Finance Minister announced spending of Rs 60,000 crore on infrastructure projects like expressways, power plant, heritage corridors and new airports.

The support to Bihar, whose ruling party and BJP’s partner JD-U has been demanding an economic package and special category status for the state, is in the form of capital projects but not subsidy or cash dole.

Similarly, for Andhra Pradesh, whose ruling TDP recently joined BJP-led NDA, she allocated Rs 15,000 crore in financial aid through multilateral agencies. A similar request for support to Bihar will be expedited, she said.

For the middle class, she raised standard deduction — a flat deduction from total salary earned by an employee in a year before calculating applicable income tax rate — by 50 per cent to Rs 75,000 and tweaked tax slabs for taxpayers opting for the new income tax regime.

This will lead to taxpayers under the new tax regime — which offers lower rates of taxes but permits limited deductions and exemptions — saving up to Rs 17,500 in tax annually, she said.

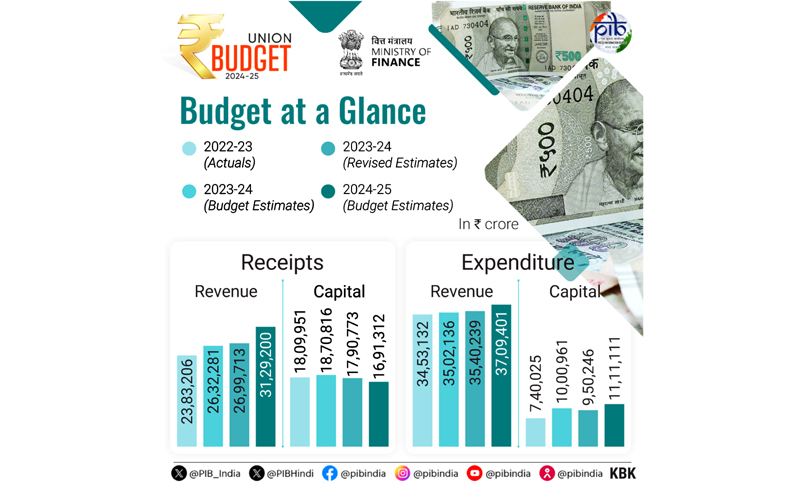

Buoyed by robust tax collections and a higher-than-expected dividend receipt from the Reserve Bank, Sitharaman said the government’s fiscal deficit — the difference between the total revenue earned and total expenditure — will be trimmed to 4.9 per cent of the GDP in 2024-25, below the 5.1 per cent figure estimated in the interim budget she presented in February.

She reduced gross market borrowing marginally to Rs 14.01 lakh crore.

The Budget for 2024-25 fiscal (April 2024 to March 2025) allocated Rs 1.52 lakh crore for agriculture and allied sectors, aid for building 3 crore affordable housing units in urban and rural areas, provided credit support to small and medium businesses, raised small loans to Rs 20 lakh for small business, proposed setting up 12 industrial parks, and provided for setting up a Rs 1,000 crore venture capital fund for space sector.

Cut in tax rate for foreign companies from 40 per cent to 35 per cent, increase in the capital gains tax on listed securities, abolition of Angel tax, taxation of buybacks in the hands of the recipient and withdrawal of 2 per cent Equalisation Levy are other big big-ticket items announced.

Tax rate for listed equity share and equity oriented mutual funds has been increased from 10 per cent to 12.5 per cent while the exemption limit being raised from 1 lakh to 1.25 lakh. Other long term capital assets like gold, property which were taxed at 20 per cent with indexation, the tax rate has been reduced to 12.5 per cent but indexation benefit has been removed.

So far as short-term capital gain for STT on paid equity shares and equity oriented mutual funds is concerned, tax rate has been increased from 15 per cent to 20 per cent.

It is proposed to allow credit of Tax Collected at Source (TCS) while computing the amount of tax to be deducted on salary income.

Meanwhile, India has set aside Rs 6,21,940 crore for defence spending in 2024-25, virtually keeping the same amount allocated in the interim budget amid the continuing border row with China in eastern Ladakh as well as concerns over the evolving security situation in the strategic waterways.

The total allocation for defence is 4.79 per cent higher than the outlay made in the financial year 2023-24.

A total of Rs 1.72 lakh crore was set aside to the military for capital expenditure that largely includes purchasing new weapons, aircraft, warships and other military hardware.

For 2023-24, the budgetary allocation for capital outlay was Rs 1.63 lakh crore while the revised estimates put the amount at Rs 1.57 lakh crore.

The revenue expenditure for day-to-day operating costs and salaries has been pegged at Rs 2.82 lakh crore while Rs 1,41,205 crore has been set aside for defence pensions, which is 2.17 per cent higher than the allocation made in 2023-24.

The total allocation made for defence in the interim budget in February was Rs 6,21,540 crore.

On the capital outlay, the defence ministry said the allocation is aimed at filling the critical capability gaps through big ticket acquisitions in current and subsequent years.

“The enhanced budgetary allocation will fulfill the requirement of annual cash outgo on planned capital acquisitions aimed at equipping the armed forces with state-of-the-art niche technology, lethal weapons, fighter aircraft, ships, submarines, platforms, unmanned aerial vehicles, drones and specialist vehicles,” it said.

The Ministry of Defence has earmarked 75 per cent of modernisation budget amounting to Rs 1,05,518.43 crore for procurement through domestic industries, it said.

“In absolute terms, budgetary allocation under capital head to the defence forces for 2024-25 is Rs 1.72 lakh crore, which is 20.33 per cent higher than the actual expenditure of 2022-23 and 9.40 per cent more than the revised allocation of 2023-24,” the ministry said in a statement.

It further said: “The continued higher allocation for operational readiness boosts the morale of the armed forces with the sole motive of keeping them battle ready at all times.” The ministry said the government has allocated Rs 92,088 crore during the current financial year under this head.

“This is aimed to provide best maintenance facilities and support system to all platforms including aircraft and ships. It will facilitate procurement of ammunition; mobility of resources personnel as demanded by the security situation, and strengthen the deployment in forward areas for any unforeseen situation,” it said.

The budgetary allocation to Border Roads Organisations (BRO) under capital head has been proposed at Rs 6,500 crore.

The outlay to Defence Research and Development Organisation (DRDO) has been increased to Rs 23,855 crore in 2024-25 from Rs 23,263 crore in 2023-24.

Out of this allocation, a major share of Rs 13,208 crore is allocated for capital expenditure.

Gold, silver and other precious metals along with imported mobile phones, certain cancer drugs and medical devices are set to become cheaper with Sitharaman announcing cuts in customs duty in the Union Budget 2024-25.

However, certain items such as imported garden umbrellas and laboratory chemicals are set to become costlier due to an increase in basic customs duty.

Sitharaman in her Budget speech on Tuesday proposed reducing “customs duties on gold and silver to 6 per cent and that on platinum to 6.4 per cent” to enhance domestic value addition for jewellery in the country.

Moreover, to provide relief to cancer patients, the finance minister proposed to fully exempt three more medicines from customs duties — Trastuzumab Deruxtecan, Osimertinib and Durvalumab.

She also proposed “changes in the BCD (basic customs duty) on x-ray tubes & flat panel detectors for use in medical x-ray machines under the Phased Manufacturing Programme, so as to synchronise them with domestic capacity addition.”

Earlier X-ray tubes used in manufacturing of X-ray machines for medical, surgical, dental or veterinary use attracted 15 per cent BCD, which has been proposed to reduce to 5 per cent.

The government also proposed slashing import duty on mobile phones, chargers and some components that are used for manufacturing of handsets.

The BCD on specified goods for use in manufacturing of connectors was in the range of 5 to 7.5 per cent and oxygen-free copper for use in manufacturing of resistors attracted 5 per cent BCD.

Similarly, customs duty on 25 critical minerals such as lithium, copper, cobalt and rare earth elements, which are critical for sectors like nuclear energy, renewable energy, space, defence, telecommunications, and high-tech electronics either got fully exemption or reduced.

“This will provide a major fillip to the processing and refining of such minerals and help secure their availability for these strategic and important sectors,” she said.

The finance minister also proposed removing BCD on specified capital goods for use in manufacturing of solar cells or solar modules and said this will “support energy transition”.

However, she withdrew customs duty exemption on import of solar glass and tinned copper interconnect “in view of sufficient domestic manufacturing capacity”.

Similarly, Sitharaman also proposed reducing BCD on certain broodstock, polychaete worms, shrimp and fish feed to 5 per cent to promote India’s seafood exports, which has touched an all-time high of more than Rs 60,000 crore in the last financial year.

For leather and textile sectors, she proposed to remove duty on import of wet white, crust and finished leather for manufacturing of textile or leather garments, footwear or other leather products for export.

“…To enhance the competitiveness of exports, I propose to reduce BCD on real down filling material from duck or goose. I am also making additions to the list of exempted goods for manufacture of leather and textile garments, footwear and other leather articles for export,” she added.

Sitharam proposed to increase BCD on garden umbrella from 20 per cent to 20 per cent or Rs 60 per piece, whichever is higher.

Moreover, to support existing and new capacities in the pipeline, she also proposed to increase the BCD on ammonium nitrate from 7.5 to 10 per cent.

Besides, she raised BCD on poly vinyl chloride (PVC) flex films, which is also known as PVC flex banners or PVC flex sheets, from existing 10 per cent to 25 per cent as they are non-biodegradable and hazardous for environment and health.

Moreover, to incentivise domestic manufacturing, the finance minister proposed to increase the BCD from 10 to 15 per cent on PCBA of specified telecom equipment from 10 to 15 per cent.

TDS of one per cent will apply on sale of an immovable property valued at Rs 50 lakh and more, even if there are multiple buyers and sellers involved in the transaction.

A clarification in this regard was provided by Finance Minister Nirmala Sitharaman in her Budget Speech amid cases of misinterpretation of tax provisions.

The Government on Tuesday said that one per cent TDS will be applicable for transfer of immovable property involving multiple sellers or buyers wherein the aggregate consideration is Rs 50 lakh or more.

The finance minister mentioned the applicability of Tax Deduction at Source (TDS) in her 2024-25 Budget speech.

In the budget document, the Government said that Section 194-IA of the Act provides for deduction of tax on payment of consideration for transfer of certain immovable property other than agricultural land. An amendment will be made in the section to clarify this.

“It is proposed to clarify that where there is more than one transferor or transferee in respect of an immovable property, then such consideration for transfer of the immovable property shall be the aggregate of the amounts paid or payable by all the transferees to the transferor or all the transferors for transfer of such immovable property,” Finance Minister Nirmala Sitharaman said in her budget speech.

As per the law, a transferee (buyer) is responsible for deducting tax at source on the amount paid to a seller or transferor for transferring immovable property to the buyer/transferee.

Meanshile, States charging high stamp duties on purchase of properties will be encouraged to bring down the rates, Finance Minister said, asserting that the reform will be a key component in urban development schemes.

She also asked states to consider further lowering stamp duties for properties bought by women.

Stamp duty is a tax imposed by State Governments on the sale of property/property ownership. It is payable under Section 3 of the Indian Stamp Act, 1899. The duty is payable at the time of registration of property if a property is acquired by way of sale deed/conveyance deed/gift deed.

For promoting women-led development, Sitharaman on Tuesday said the budget carries an allocation of more than Rs 3 lakh crore for schemes benefitting women and girls.

She said this signals the government’s commitment in enhancing women’s role in economic development.

“For promoting women-led development, the budget carries an allocation of more than Rs 3 lakh crore for schemes benefitting women and girls,” she said.

Sitharaman said the government will set up working women hostels to promote their participation in the workforce.

One of the key highlights of the budget include establishment of working women hostels in partnership with industries and creches to support working mothers.

These initiatives are aimed at enhancing work-home balance for women, thus encouraging their greater participation in the workforce.

Imported mobile phones will become cheaper by up to 6 per cent as the Government in the FY25 budget has reduced customs duty on such shipments to 15 per cent from 20 per cent earlier.

Sitharaman, while presenting the Union Budget for fiscal year 2024-25 on Tuesday, proposed slashing import duty on mobile phones, chargers and some components that are used for manufacturing of handsets.

She said with a three-fold increase in domestic production and almost 100-fold jump in exports of mobile phones over the last six years, the Indian mobile phone industry has matured.

“In the interest of consumers, I now propose to reduce the BCD (basic customs duty) on mobile phone, mobile PCBA and mobile charger to 15 per cent,” Sitharaman said.

Earlier BCD on mobile phones, chargers and motherboards was 20 per cent.

Mobile phone industry body ICEA said that the move will enhance export competitiveness of India in the segment.

The Government announced 3 schemes to boost employment through retirement fund body EPFO for new entrants in the organised sector with a total central outlay of Rs 1.07 lakh crore.

Sitharaman said, “Our Government will implement 3 schemes for ‘Employment Linked Incentive’, as part of the Prime Minister’s package.”

These will be based on enrolment in the Employees’ Provident Fund Organisation, and focus on recognition of first-time employees, and support to employees and employers, she said.

For the first-timers, she told the House that Scheme-A will provide one-month wage to all persons newly entering the workforce in all formal sectors.

The direct benefit transfer of one-month salary in 3 instalments to first-time employees, as registered in the EPFO, will be up to Rs 15,000.

The eligibility limit will be a salary of Rs 1 lakh per month. The scheme is expected to benefit 210 lakh youth.

The Scheme-B for job creation in manufacturing will incentivize additional employment in the manufacturing sector, linked to the employment of first-time employees.

An incentive will be provided at specified scale directly both to the employee and the employer with respect to their EPFO contribution in the first 4 years of employment, she stated.

The scheme is expected to benefit 30 lakh youth entering employment, and their employers.

Similarly, Scheme-C for support to employers, will cover additional employment in all sectors.

All additional employment within a salary of Rs 1 lakh per month will be counted.

The government will reimburse to employers up to Rs 3,000 per month for 2 years towards their EPFO contribution for each additional employee.

The scheme is expected to incentivize additional employment of 50 lakh persons, she added.

The three schemes will have total central outlay of Rs 1.07 lakh crore (Rs 23,000 crore for Scheme-A, Rs 52,000 crore for Scheme-B and Rs 32,000 crore for Scheme-C).

Sitharaman said,”Our government will facilitate the provision of a wide array of services to labour, including those for employment and skilling.”

Sitharaman said a solution will be evolved with respect to the New Pension Scheme (NPS) that will address relevant issues and ensure fiscal prudence.

Sitharaman said the Committee to review the NPS has made considerable progress in its work.

She said the staff side of the National Council of the Joint Consultative Machinery for Central Government Employees have taken a constructive approach.

“A solution will be evolved which addresses the relevant issues while maintaining fiscal prudence to protect the common citizens,” the minister said.

Under the OPS, retired government employees received 50 per cent of their last drawn salary as monthly pensions. The amount keeps increasing with the hike in the DA rates.

The Finance Minister also announced measures to improve social security benefits.

Towards this, she said deduction of expenditure by employers towards NPS is proposed to be increased from 10 to 14 per cent of the employee’s salary.

Similarly, deduction of this expenditure up to 14 per cent of salary from the income of employees in private sector, public sector banks and undertakings, opting for the new tax regime, is proposed to be provided.

The Finance Minister also proposed to start ‘NPS-Vatsalya’, a plan for contribution by parents and guardians for minors.

On attaining the age of majority, the plan can be converted seamlessly into a normal NPS account.

In a bid to provide jobs to the youth, Nirmala Sitharaman proposed to launch an ambitious scheme for providing internship opportunities in 500 top companies to 1 crore youth over a five-year period.

Under the scheme, an internship allowance of Rs 5,000 per month, along with a one-time assistance of Rs 6,000 will be provided to youths.

“As the 5th scheme under the Prime Minister’s package, our Government will launch a comprehensive scheme for providing internship opportunities in 500 top companies to 1 crore youth in five years,” Sitharaman said in her Budget speech.

These youths will gain exposure for 12 months to real-life business environments, varied professions and employment opportunities.

She said that companies will bear the training cost and 10 per cent of the internship cost from their CSR (corporate social responsibility) funds.

As per the Companies Act 2013, certain classes of profitable organisations are required to shell out at least 2 per cent of the three-year annual net profit towards CSR activities in a particular financial year.

Meanwhile, the Government announced central assistance of Rs 2.2 lakh crore over the next five years to meet housing requirement of 1 crore urban poor and middle class families under the Pradhan Mantri Awas Yojana-Urban and proposed interest subsidy to provide loans at affordable rates.

Sitharaman said, “Under the PM Awas Yojana Urban 2.0, housing needs of 1 crore urban poor and middle-class families will be addressed with an investment of Rs 10 lakh crore.”

“This will include the Central assistance of Rs 2.2 lakh crore in the next 5 years,” she added.

The Government also plans to provide interest subsidy to facilitate loans at affordable rates, the minister said.

Sitharaman proposed that the Government will put in place policies for promoting rental housing markets.

“…Enabling policies and regulations for efficient and transparent rental housing markets with enhanced availability will also be put in place,” she said.

Further, the minister said the Government will facilitate rental housing with dormitory-type accommodation for industrial workers.

This will be done in PPP (public-private partnership) mode with VGF support and commitment from anchor industries.

Meanwhile, the Union Budget 2024-25 allocated Rs 2,19,643.31 crore to the Ministry of Home Affairs with the majority of it — Rs 1,43,275.90 crore — being given to central police forces like the CRPF, BSF, and CISF which are responsible for internal security, border guarding, and security of vital installations.

The interim budget 2024-25 had allocated Rs 2,02,868.70 crore to the home ministry, helmed by Union Home Minister Amit Shah.

Meanwhile, Rs 3,756.51 crore has been allocated to the Border Infrastructure and Management, Rs 3,152.36 crore has been given for developing police infrastructure, Rs 1,105 crore for schemes related to women’s safety, Rs 9,305.43 crore for various central sector projects and schemes sponsored by the home ministry, Rs 3,199.62 crore for security-related expenditure and Rs 1,050 crore for Vibrant Villages Programme.

The budget allotted Rs 1,248.91 crore to the Cabinet under which the expenditure on the council of ministers, cabinet secretariat, Prime Minister’s Office, hospitality and entertainment of the government comes while Rs 6,458 crore has been given for disaster management, relief and rehabilitation and grants-in-air to state governments among others.

The Safe City Project has been allotted Rs 214.44 crore, the National Forensic Science University got Rs 80 crore and the Rashtriya Raksha University has been given Rs 90 crore.

The Department of Empowerment of Persons with Disabilities has been allocated a total of Rs 1,225.27 crore in the fiscal year 2024-2025, a marginal increase of 0.02 per cent from the previous year’s revised estimate of Rs 1,225.01 crore.

The budget emphasises the continuation and expansion of key programmes aimed at improving the lives of persons with disabilities through various schemes and projects.

A significant portion of the budget is dedicated to the National Program for the Welfare of Persons with Disabilities, with Rs 615.33 crore allocated for this fiscal year, up from Rs 502 crore in the revised budget for 2023-24.

The Department of Empowerment of Persons with Disabilities (DEPwD) has been allocated a total of Rs 1,225.27 crore in the fiscal year 2024-25, a marginal increase of 0.02 per cent from the previous year’s revised estimate of Rs 1,225.01 crore. (PTI)