Customs duty imposed on many items, hiked on others; 1% TDS on e-commerce cos

* Govt to facilitate growth of MSMEs

* Steps to double farmers’ income by 2022

NEW DELHI, Feb 1: Finance Minister Nirmala Sitharaman today slashed income tax for individuals, abolished dividend tax for companies and announced record spending in agriculture and infrastructure sectors to pull out the economy from its worst slowdown in more than a decade.

Click here to watch video

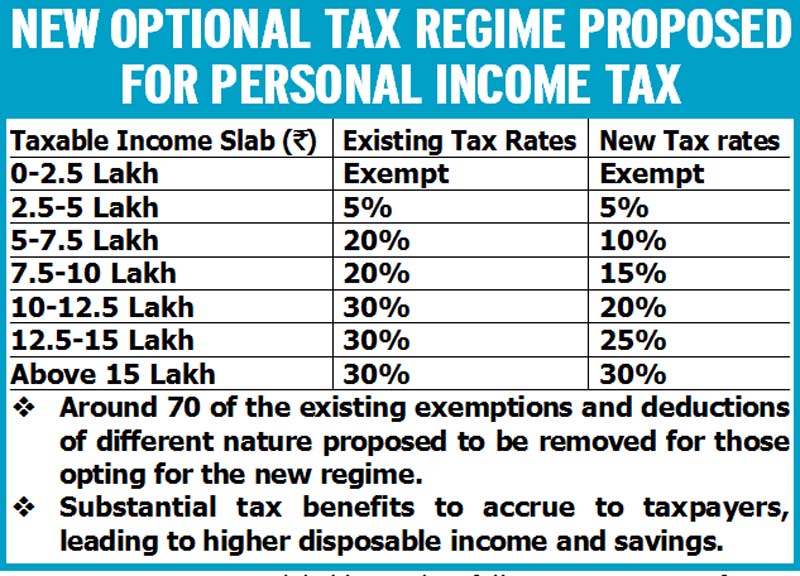

The cut in income tax rates, which would help save about Rs 31,000 a year in tax for persons with annual income of up to Rs 17 lakh, was however conditioned on current exemptions and deductions including standard deduction for Rs 50,000 as well as the waiver earned on payment of up to Rs 1.5 lakh in tuition fee of children, and contribution towards insurance premium and provident fund, being given up.

She raised import duty on a variety of products ranging from tableware and kitchenware to electrical appliances to footwear, furniture, stationery and toys to boost domestic manufacturing while at the same time provided funds to help farmers set up solar power generation units and set up coal storages to transport perishables.

She raised import duty on a variety of products ranging from tableware and kitchenware to electrical appliances to footwear, furniture, stationery and toys to boost domestic manufacturing while at the same time provided funds to help farmers set up solar power generation units and set up coal storages to transport perishables.

Alongside, the limit of insurance cover in case of bank failure on deposits was increased to Rs 5 lakh from Rs 1 lakh and a sale of government stake in the country’s largest insurer Life Insurance Corporation (LIC) announced.

Presenting her second budget in Parliament, Sitharaman said the 2020-21 Budget was aimed at boosting incomes and enhancing purchasing power, stressing that the economy’s fundamentals were strong and inflation was well contained.

For farm and rural sectors, she allocated Rs 2.83 lakh crore and fixed Rs 15 lakh crore target for giving agriculture credit. Another Rs 1.7 lakh crore spending was planned for transport infrastructure and Rs 40,740 crore allocation was made for the energy sector.

In doing so, the government will miss its deficit target for the third year in a row, pushing shortfall to 3.8 per cent of GDP in the current fiscal as compared to 3.3 per cent previously planned. The fiscal deficit target for the coming fiscal year starting April 1 has been fixed at 3.5 per cent.

Sitharaman, who cut tax paid by companies to its lowest in September last year, proposed new tax slabs of 15 per cent and 25 per cent in addition to the existing 10 per cent, 20 per cent and 30 per cent. The new slabs would be for individuals not availing certain specified deductions or exemptions.

Under the proposed I-T slab, annual income up to Rs 2.5 lakh is exempt from tax. Those individuals earning between Rs 2.5 lakh and Rs 5 lakh will pay 5 per cent tax. A 10 per cent tax will be charged on income between Rs 5 and 7.5 lakh, 15 per cent, 20 per cent and 25 per cent on next Rs 2.5 lakh each and 30 per cent on income above Rs 15 lakh.

“Currently, annual income up to Rs 2.5 lakh is exempt from income tax. While a 5 per cent tax is charged for income between Rs 2.5 and 5 lakh. 20 per cent for income between Rs 5 lakh and Rs 10 lakh and 30 per cent for those earning above Rs 10 lakh.

Sitharaman accepted the demand of the industry to reverse the taxability of dividends back to the recipients, making equity investment more attractive. Now, dividends will be taxed in the hands of recipients, a move that will cause Rs 25,000 crore dent to her coffers.

Also, she deferred taxes for ESOPs in the hands of employees which will be an important decision for the employees to own shares in the employer without getting worried about organising cash to pay taxes. This will also provide greater flexibility to the employers and employees in the structuring of their employment prospects.

One proposal that could be become contentious was tax being imposed on Indian citizens abroad if they are not taxable in their home country.

For the next fiscal, she pegged net borrowings of Rs 5.45 lakh crore and doubled target of raising revenue from the sale of government stake in PSUs to Rs 2.1 lakh crore.

Aiming to boost the affordable housing demand, Sitharaman proposed to extend the date of availing an additional Rs 1.5 lakh tax deduction on home loan interest by one more year till March 2021.

The additional deduction of Rs 1.5 lakh over and above Rs 2 lakh was introduced in the last year’s budget. This was allowed for those buying homes for the first time and of up to Rs 45 lakh and made applicable for home loans sanctioned till March this year.

The Finance Minister also announced that builders will get tax holiday on affordable housing projects approved till March 2021.

As per the Budget document, an individual taxpayer opting for the new tax regime will not be entitled for deduction under 80C of the Income Tax.

Section 80C provides deduction for contribution towards insurance premium, deferred annuity, provident fund and certain type of shares.

Taxpayer will also have to forego deduction under 80CCC (contribution towards certain pension fund), Section 80D (health insurance), 80E (interest on loan for higher education), 80EE (interest on loan taken for residential property), 80EEB (purchase of electric vehicle), 80G (donation to charitable institutions), and 80G (rent paid).

Besides, a taxpayer opting for the new scheme will not get tax benefit for leave travel concession (LTC), allowances for income of minors, and certain allowances of MPs/MLAs.

The tax benefit will not be available in respect free food and beverages through vouchers provided to employees.

However, certain deductions are proposed to be retained in the new regime, like conveyance allowance for meeting expenses in performance of duty and allowance for travel on tour and transfers.

Meanwhile, in a marginal hike, the defence budget was increased to Rs 3.37 lakh crore for 2020-21 against last year’s Rs 3.18 lakh crore, belying expectations of a significantly enhanced allocation to fast-track long-pending military modernisation.

Out of total allocation, Rs 1.13 lakh crore has been set aside for capital outlay to purchase new weapons, aircraft, warships and other military hardware, according to Sitharaman.

The revenue expenditure which includes expenses on payment of salaries and maintenance of establishments has been pegged at Rs 2.09 lakh crore.

The total outlay does not include Rs 1.33 lakh crore set aside separately for payment of pensions.

The percentage of the allocation has almost remained static at around 1.5 per cent of the GDP which, according to experts, is the lowest since the 1962 war with China.

Sitharaman also announced a host of measures including relaxing tax incentives and setting up of investment clearance cell for startups and entrepreneurs with a view to promote their growth.

The Minister has also proposed to provide early life funding, including a seed fund to support ideation and development of early stage startups.

She asked all the infrastructure agencies of the Government to involve startups as they will help in rolling out value-added services in quality public infrastructure for citizens.

Sitharaman has proposed easing of tax payments for startups – a decision which was hailed by budding entrepreneurs.

“In order to give a boost to startup ecosystem, I propose to ease the burden of taxation on the employees by deferring the tax payment by five years or till they leave the company or when they sell, whichever is earliest,” she said while presenting the Union Budget for 2020-21.

Further, the minister said that an eligible startup having a turnover of up to Rs 25 crore is allowed a deduction of 100 per cent of its profits for three consecutive assessment years out of seven years, if the total turnover does not exceed Rs 25 crore.

“In order to extend this benefit to larger startups also, I propose to increase the turnover limit from existing Rs 25 crore to Rs 100 crore.

“Moreover, considering the fact that in the initial years, a startup may not have adequate profit to avail this deduction, I propose to extend the period of eligibility for claim of deduction from the existing 7 years to 10 years,” Sitharaman said.

She proposed a new levy of one per cent TDS (tax deducted at source) on e-commerce transactions, a move that could increase burden on sellers on such platforms.

“In order to widen and deepen the tax net by bringing participants of e-commerce (sellers) within tax net, it is proposed to insert a new section 194-O in the Act so as to provide for a new levy of TDS at the rate of one per cent,” as per 2020-21 Budget documents.

She also announced increase in customs duty on imported wall fans, tableware and kitchenware.

In Budget 2020-21, Sitharaman also proposed withdrawal of customs duty exemption on raw sugar, agro-animal based products, tuna bait, skimmed milk, certain alcoholic beverages, soya fibre and soya protein.

Customs duty on wall fans increased from 7.5 per cent to 20 per cent, while the same on tableware/kitchenware made of porcelain or China ceramic, clay iron, steel and copper has been doubled to 20 per cent.

Moreover, customs duty on catalytic converters, parts of commercial vehicles, other than electric vehicles, have also been hiked.

On the other hand, anti-dumping duty on purified terephthalic acid (PTA), which is used in production of high-performance multipurpose plastics, has been abolished.

The Budget also provided for e-commerce operators to deduct TDS on all payments to e-commerce participants at 1 per cent with PAN/Aadhaar, 5 per cent in non-PAN/Aadhaar.

Meanwhile, the lower income tax rates will apply only those for individuals foregoing exemptions under Section 80C, 80D, LTC, HRA among others.

Imported electric vehicles are set to become costlier as the Finance Minister announced an increase in customs duty on various kinds of such vehicles as the Government pushes to promote local production.

“Under ‘Make in India’ initiative, well laid-out customs duty rates were pre-announced for items like mobile phones, electric vehicles and their components. This has ensured gradual increase in domestic value addition capacity in India,” Sitharaman said.

Customs duty rates are being revised on electric vehicles (EVs), and parts of mobiles as part of such carefully conceived phased manufacturing plans, she added.

To push local manufacturing in the EV segment, the Government has increased customs duty on imported completely built units (CBUs) of commercial EVs to 40 per cent with effect from April 1, 2020, from 25 per cent currently.

The Finance Minister also proposed to enhance customs duty on semi knocked-down (SKD) forms of passenger EVs from 15 per cent to 30 per cent.

Similarly, the Government has proposed to hike customs duty on SKD forms of electric buses, trucks and two-wheelers to 25 per cent from 15 per cent currently, with effect from April 1, 2020.

Besides, the customs duty on completely knocked-down (CKD) forms of passenger EVs, three-wheelers, two-wheelers, bus and trucks has been proposed to go up to 15 per cent from the current 10 per cent.

Sitharaman also announced increasing customs duty on imported footwear and furniture.

Sitharaman said 100 more airports will be developed by 2025 to support the UDAN scheme.

She said Rs 1.7 lakh crore has been provided for transport infrastructure in 2020-21.

She also said 1,150 trains will run under the public private partnership (PPP) mode, also four stations will be redeveloped with the help of the private sector.

Besides, the minister promised more Tejas type trains to connect tourist destinations.

She said a proposal for setting up large solar power capacity alongside rail track is under consideration.

With 4.83 lakh direct tax cases under litigation, the Government proposed to come out with a new scheme wherein such taxpayers can pay due taxes by March 31 and get complete waiver of interest and penalty.

The ‘Vivad Se Vishwas’ scheme announced in Budget 2020-21 by Sitharaman would help in reducing litigation.

Under the proposed scheme, a taxpayer would be required to pay only the amount of the disputed taxes and will get complete waiver of interest and penalty provided he pays by March 31, 2020.

“Those who avail this scheme after March 31, 2020, will have to pay some additional amount. The scheme will remain open till June 30, 2020,” Sitharaman said in her Budget speech.

Old coal-fired power plants not meeting emission norms will be closed and their land put to alternative use, Sitharaman said as she provided Rs 4,400 crore in her Budget for measures to ensure clean air.

She also announced expansion of PM KUSUM scheme for harnessing solar energy by farmers for achieving diesel-free agriculture eventually.

Besides, the Minister indicated that there would be a new scheme to reduce financial stress of debt-laden power distribution firms and incentives will be provided in form of lower corporate tax for new power projects.

“There are yet, thermal power plants that are old and their carbon emission levels are high. For such power plants, we propose that utilities running them would be advised to close them, if their emission is above the pre-set norms. The land so vacated can be put to alternative use,” Sitharaman said.

The new scheme would be implemented by environment ministry with an outlay of Rs 4,400 crore.

A degree level full-fledged online education programme will be offered by the country’s top 100 educational institutions to students belonging to deprived sections of the society and those who do not have access to higher studies, the Finance Minister said.

Sitharaman said a new education policy will soon be announced and the Government proposes to provide about Rs 99,300 crore for the education sector in 2020-21 and about Rs 3,000 crore for skill development.

“By tying skill development with education, Finance Minister Nirmala Sitharaman has given wings to the Skill India Mission and the overall skilling ecosystem of the country. India is a treasure trove of gifted individuals who must be skilled in order for them to realise their dreams.

“The Rs 3,000 crore outlay will give an impetus to vocational education and training. Under the current plans, we are already proving skill training across 8,000 schools and institutes, with 400 hours in classes 9-10 and 500 hours in classes 11-12 for one trade. The Budget 2020 makes a provision for expanding the net to other schools as well,” Union Skill Development and Entrepreneurship Minister Mahendra Nath Pandey said.

The Finance Minister also announced that a special bridge course would be designed by ministries of health and skill development and entrepreneurship in conjunction with professional bodies to bring in equivalence and improve the skillsets of teachers, nurses, paramedical staff and care-givers.

Meanwhile, the Government unveiled measures aimed at facilitating growth of the country’s micro, small and medium enterprises and reducing their compliance burden, including raising the turnover threshold for audit of their accounts to Rs 5 crore and a scheme to provide subordinate debt to MSME entrepreneurs.

Unveiling the 2010-21 budgetary proposals in Parliament, Sitharaman underlined the importance of MSMEs saying they are vital for keeping the wheels of the economy moving and also for creating employment opportunities.

“Currently, only businesses having a turnover of more than Rs 1 crore are required to get their books of accounts audited by an accountant. In order to reduce compliance burden on small retailers, traders, shopkeepers who comprise the MSME sector, I propose to raise by five times the turnover threshold for audit from the existing rupees one crore to five crore,” Finance Minister Nirmala Sitharaman said while presenting the Budget 2020-21.

She said a scheme will be introduced to provide subordinate debt to MSME entrepreneurs.

Besides, the government has also asked the Reserve Bank to extend the debt restructuring window for micro, small and medium enterprises by a year to March 31, 2021, Sitharaman said.

“An app-based invoice financing loans product will be launched. This will obviate the problem of delayed payments and consequential cash flow mismatches for the MSMEs,” said the Finance Minister.

She said, necessary amendments will be made to the Factor Regulation Act 2011 to enable non banking financial companies (NBFCs) to extend invoice financing to the MSMEs through TReDS, thereby enhancing their economic and financial sustainability.

Sitharaman proposed to cut the import duty on newsprint to five per cent.

The Government in the last budget had imposed 10 per cent basic custom duty on newsprint and lightweight coated paper.

“However, since then I have received several references that this levy has put additional burden on print media at a time when it is going through a difficult phase. I, therefore, propose to reduce basic customs duty on imports of newsprint and light-weight coated paper from 10 per cent to 5 per cent,” she said while presenting the Union Budget for 2020-21.

The Government proposed 11 per cent increase in the farm credit target to 15 lakh crore for 2020-21 and announced special rail and flight services for the transportation of farm produce as its seeks to double farmers’ income by 2022.

The Government also proposed promoting ‘one product one district’ for better marketing and export of horticulture crops. It also called on states for early implementation of three key central model laws on land leasing, agriculture produce and livestock marketing and contract farming.

Sitharaman said, “Our Government is committed to the goal of doubling farmers’ incomes by 2022.”

She further said that prosperity of farmers can be ensured by making farming competitive. “For this, farm markets need to be liberalised. Distortions in farm and livestock markets need to be removed.”

Purchase of farm produce, logistics and agri-services need copious investments. Substantial support and hand-holding of farm-based activities such as livestock, apiary, and fisheries need to be provided for, she said.

Barely two years left for achieving the target of doubling farmers income, the Finance Minister said farmers desire integrated solutions covering storage, financing, processing and marketing.

To improve marketing, Sitharaman said the Indian Railways will set up a “Kisan Rail” – through public private partership (PPP) arrangements — to build a seamless national cold supply chain for perishables, inclusive of milk, meat and fish.

There would be refrigerated coaches in Express and Freight trains as well.

‘Krishi Udaan’ will be launched by the Civil Aviation Ministry on international and national routes. This will immensely help improve value realisation especially in North-East and tribal districts, she added.

To provide better access to bank credit, the government proposes raising the target for disbursing agriculture credit to Rs 15 lakh crore for the 2020-21 fiscal from the current target of Rs 13.5 lakh crore.

Normally, farm loans attract an interest rate of 9 per cent. But the government is providing 2 per cent interest subsidy to ensure farmers get short-term farm loan of up to Rs 3 lakh at an effective rate of 7 per cent per annum. (PTI)

Budget has both vision, action: PM

Asserting that the Union Budget will accelerate the economic growth, financially empower every citizen and strengthen the foundation of the economy in the new decade, Prime Minister Narendra Modi today heaped praise on it for having both “vision and action”.

Asserting that the Union Budget will accelerate the economic growth, financially empower every citizen and strengthen the foundation of the economy in the new decade, Prime Minister Narendra Modi today heaped praise on it for having both “vision and action”.

He also said provision of faceless appeal, new and simple structure of direct tax, move towards unified procurement system, stress on disinvestment are some of the steps which will reduce the Government out of people’s lives and will enhance their “ease of living”.

“I believe that this budget will increase income and investment, increase demand and consumption, bring new vigour in the financial system and credit flow,” he said

The budget, Modi noted, will meet the current needs of the country as well as the future expectations in the decade.

“The new reforms announced in the budget will work to accelerate the economy, financially empower every citizen of the country and strengthen the foundation of the economy in this decade,” Modi said in his comments.

Noting that the main areas of employment are agriculture, infrastructure, textiles and technology, he said the four have been given great emphasis in the budget to increase employment generation.

Referring to the Government’s efforts to double the income of farmer, he said 16 action points have been created which will serve to increase employment in rural areas.

Integrated approach has been adopted for the agriculture sector in the budget, which along with traditional methods will increase value addition in horticulture, fisheries, animal husbandry and also increase employment, he said.

“Under the Blue Economy, the youth will also get new opportunities in the field of fish processing and marketing,” Modi noted.

According to the World Bank, the blue economy is the sustainable use of ocean resources for economic growth, improved livelihoods, and jobs while preserving the health of ocean ecosystem.

The Prime Minister said new mission for technical textile has been announced. Man-made fibre has been reformatted into the duty structure of its raw material to be produced in India. This reform was in demand for the last three decades, he pointed out.

Referring to the Ayushman Bharat scheme, Modi said it has given a new expansion to the health sector of the country.

“In this sector, there has been a lot of scope for human resources – doctors, nurses, attendants as well as medical device manufacturing. New decisions have been taken by the government to increase it,” he said.

The Ayushman Bharat Yojana, also known as the Pradhan Mantri Jan Arogya Yojana (PMJAY), is a scheme that aims to help economically vulnerable Indians who are in need of healthcare facilities.

Prime Minister Modi had rolled out the scheme in September 2018.

He said in the budget, the government has made several special efforts to promote employment generation in the field of technology.

A number of policy initiatives have been taken for areas such as new smart cities, electronic manufacturing, data centre parks, biotechnology and quantum technology.

He hoped that India will move strongly towards becoming an integral part of the global value chain.

He pointed out that new and innovative initiatives have been announced regarding skill development of youth.

“For example, apprenticeships in degree courses, internships in local bodies and provision of online degree courses. Bridge courses are also being arranged for young people from India who want to go abroad for jobs,” he said.

Modern infrastructure is of great importance for modern India, he said, adding that the infrastructure sector is also a large employment generator. “Construction of 6,500 projects from Rs 100 lakh crore will increase employment opportunities in a big way. The National Logistics Policy will also benefit trade, business and employment. In the field of infrastructure, we will give new power to youth energy through start-ups and through project development,” he said.

Describing investment is the biggest driver for employment, he said some historical steps have been taken in this direction. (PTI)

Simplified GST return from Apr

A simplified return format for GST is being introduced from April 2020, Finance Minister Nirmala Sitharaman said today.

In her second Budget presentation, the Finance Minister said GST has resulted in gains of Rs 1 lakh crore to consumers and removed inspector raj and also helped the transport sector.

“Average household now saves 4 per cent in monthly expense after the rollout of GST,” Sitharaman said, and added that the Budget for 2020-21 aims to fulfil aspirations of people. (PTI)

Highlights

* Budget proposes new income tax structure for individuals willing to forego certain exemptions and deductions

* Under the new structure, income of Rs 5-7.5 lakh to attract 10 per cent tax, Rs 7.5-Rs 10 lakh 15 per cent, Rs 10-12.5 lakh 20 per cent, Rs 12.5-15 lakh 25 per cent, above Rs 15 lakh 30 per cent

* Income up to Rs 5 lakh to remain exempt from tax

* Bank deposit insurance coverage increased to Rs 5 lakh from Rs 1 lakh

* Dividend Distribution Tax at the hands of companies abolished; dividend to be taxed at the hands of recipients as per applicable slab

* Govt to sell part of stake in LIC through IPO

* Fiscal deficit for FY20 estimated at 3.8 per cent, up from 3.3 per cent projected earlier

* Fiscal deficit for 2020-21 projected at 3.5 per cent

* 2020-21 net market borrowing pegged at Rs 5.36 lakh crore

* Disinvestment proceeds pegged at Rs 1.20 lakh crore for 2020-21, up from Rs 65,000 crore in current fiscal

* Receipts estimated at 22.46 lakh crore, expenditure at Rs 30.42 lakh crore in 2020-21 based on nominal GDP growth of 10 per cent

* PAN to be allotted instantly on the basis of Aadhaar

* India fifth-largest economy, USD 284 billion FDI inflows during 2014-19

* Central Government debt reduced to 48.7 per cent of GDP in March 2019, from 52.2 per cent in March 2014

* Proposal to sell the balance Government holding in IDBI Bank to private, retail and institutional investors through stock exchanges

* Defence outlay pegged at Rs 3.23 lakh crore in 2020-21, up from Rs 3.16 lakh crore this financial year

* Railways to set up ‘Kisan Rail’ through PPP

* Krishi Udaan will be launched by civil aviation ministry on international and national routes

* Outlay for agriculture and allied activities pegged at Rs 2.83 lakh crore, Nabard’s re-finance scheme to be further expanded

* Agriculture credit target for the year 2020-21 set at Rs 15 lakh crore

* Viability gap funding for setting up hospitals in PPP mode under Ayushman Bharat

* Health sector and Swachh Bharat outlay pegged at Rs 69,000 crore and Rs 12,300 crore, respectively, in 2020-21

* New Education Policy to be announced soon

* Steps would be taken to enable sourcing external commercial borrowings and FDI in higher education

* National Police University and National Forensic Science University are being proposed

* Rs 99,300 crore outlay for the education sector in 2020-21 and Rs 3,000 crore for skill development

* Proposes ‘Investment Clearance Cell’ to provide ‘end-to-end’ facilitation and support, including pre-investment advisory, information related to land banks and facilitate clearances at Centre and state level

* Proposes a scheme focussed on encouraging manufacture of mobile phones, electronic equipment and semi-conductor packaging

* National Technical Textiles Mission proposed with a 4-year implementation period from 2020-21 to 2023-24 at an outlay of Rs 1,480 crore

* NIRVIK scheme being launched to provide for higher insurance coverage, reduction in premium for small exporters and simplified procedure for claim settlements

* Proposes to digitally refund to exporters duties and taxes levied at the central, state and local levels

* National Logistics Policy to be released soon, to create a single-window e-logistics market and focus on employment generation

* Delhi-Mumbai Expressway would be completed by 2023, Chennai-Bengaluru Expressway would also be started

* More Tejas-type trains will connect iconic tourist destinations

* High-speed train between Mumbai and Ahmedabad would be actively pursued

* The Government would consider corporatising at least one major port and, subsequently, its listing on bourses

* Rs 1.70 lakh crore outlay for transport infrastructure in 2020-21

* Urges states and UTs to replace conventional energy meters by prepaid smart meters in the next 3 years to give consumers the freedom to choose the supplier. Further, measures to reform Discoms would be taken

* Rs 22,000 crore outlay for the power and renewable energy sector in 2020-21

* Proposes to expand the national gas grid from the present 16,200 km to 27,000 km

* To deepen gas markets in India, further reforms will be undertaken to facilitate transparent price discovery and ease of transactions

* Policy to enable private sector to build data centre parks throughout the country soon

* Rs 6,000 crore outlay to the BharatNet programme in 2020-21

* Proposes a task force to recommend on women’s marriageable age

* Budget allocation of Rs 85,000 crore for Scheduled Castes and Other Backward classes, Rs 53,700 crore for Scheduled Tribes for 2020-21

* Amendments proposed in Companies Act

* Rs 30,757 crore allocated to Union territories of J&K and Ladakh

* Govt to ask RBI to allow MSMEs to restructure debt till March 31, 2021

* FPI limit in corporate bonds hiked to 15 per cent of outstanding stock, from 9 per cent

* New debt-ETF, consisting primarily of government securities, to be floated

* Proposes lower tax rates for cooperatives at 22 per cent with 10 per cent surcharge and 4 per cent cess. (PTI)