MUMBAI, Aug 8: After an unconventional 35 basis

points reduction in the repo rate, the Reserve Bank is likely

to go in for another 25 basis points rate reduction in the

December quarter amid growing concerns over growth, says a

report.

In the third bi-monthly monetary policy review, the

central bank cut the repo rate for the fourth time in a row to

5.40 percent– a nine-year low, and retained neutral stance

going forward.

The central bank also revised downwards the projection

of GDP growth to 6.9 percent for FY20 from 7 percent in its

June estimate.

“We now see a high probability of another cut by 25

basis points rate cu in Q4 of 2019,” Goldman Sachs said in a

research report Thursday.

The RBI also said the CPI inflation is projected at

3.1 percent for second quarter of FY20 and 3.5-3.7 per cent

for the second half.

Beyond the fourth quarter of 2019, the report does not

see space for further cuts primarily as headline inflation is

likely to pick up and cross the 4 percent target by the end of

the year, and output gaps are also estimated to close.

It further said the RBI has been increasingly

responsive to global and domestic growth concerns.

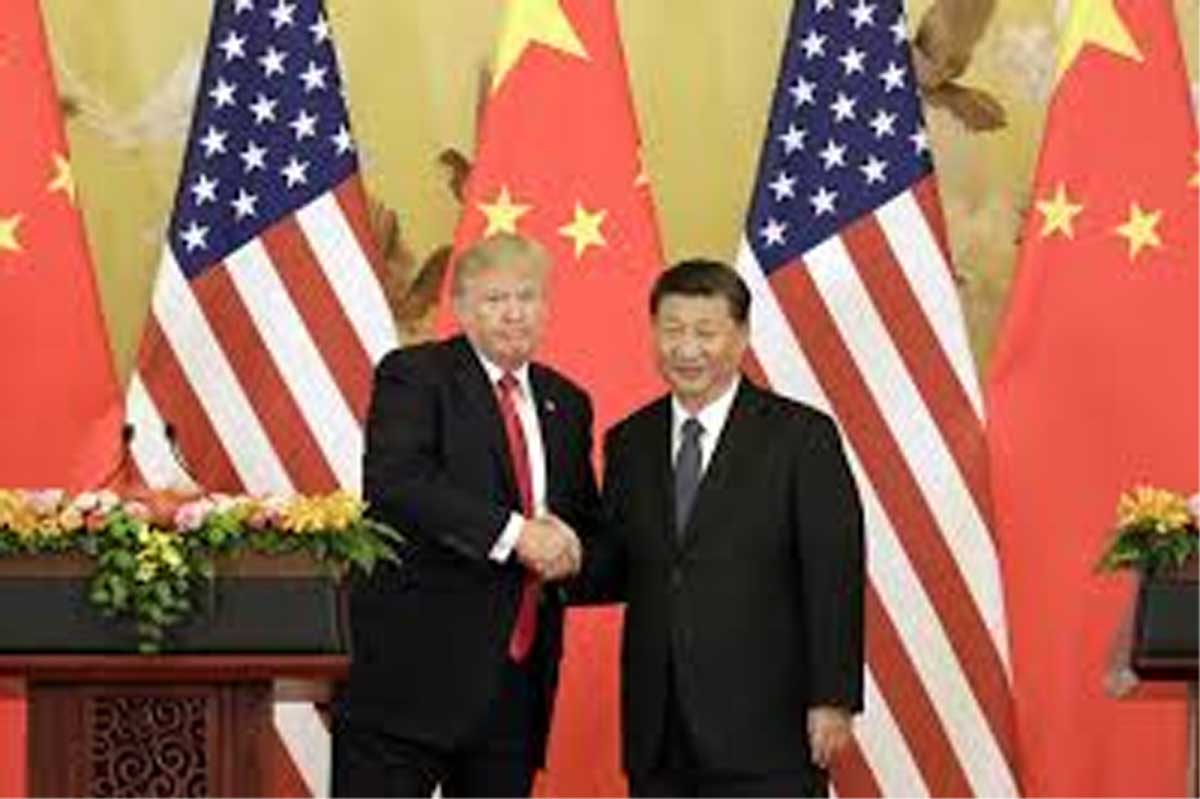

“In light of growing global trade policy risks, and

the possibility of a no-deal Brexit, risks are likely skewed

towards further reduction in the rates,” the report said.

Markets still think there would be space for another

50 bps reduction in the policy rates over the next two years,

it added. (PTI)