NEW DELHI, June 6:

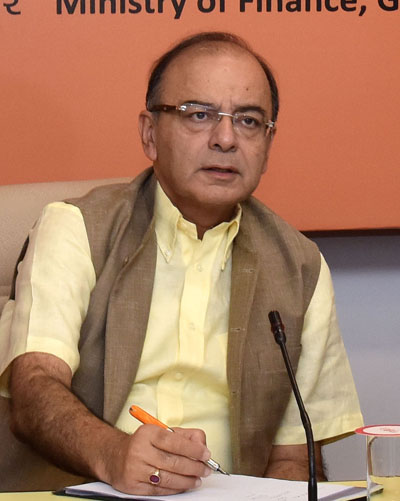

Committing to support NPA-ridden public sector banks, Finance Minister Arun Jaitley today said they would be empowered and protected in case of “commercially prudent” settlement of bad debts.

With provisioning for NPAs or bad debts leading to Rs 18,000 crore of accumulated net loss for about a dozen banks, he said the government will not hesitate to provide capital beyond the Rs 25,000 crore budgeted for the current fiscal.

After meeting top executives of state-run banks, Jaitley said the Indian Banks’ Association – a representative body of management of banking in India – would discuss and suggest a mechanism to handle settlements of non-performing assets (NPAs) or bad debts.

“The IBA would be examining some of the suggestions. The government would be also open for discussion…To the suggestions that the banks further put forward with regard to resolving the stress that has been created.

“One of the key considerations was that in situations like these banks should be empowered and consequently should be protected so that they can bring about commercially prudent settlements,” Jaitley said after the review meeting with the heads of public sector banks.

He said the PSBs clocked operational profit in excess of Rs 1.40 lakh crore last fiscal and the cumulative losses of Rs 18,000 crore suffered by them were mainly on account of higher provisioning for bad loans.

“The overall operational profit of the PSBs last year was quite significant. It was in excess of Rs 1.40 lakh crore… It is on account of the provisioning that overall the PSBs declared a net loss of about Rs 18,000 crore and a significant amount of provisioning having been made in the last two quarters (of last fiscal),” Jaitley said.

Talking about road ahead to deal with the bad loan problem, Jaitley said the bank CEOs and government had a candid discussion on the subject.

“Various suggestions have come up with regard to empowering the banks itself to function in an environment where, on commercially prudent considerations, they can deal with the situation. The government is fully committed to supporting the banks in this regard,” he added.

With regard to specific suggestions made for recovery of bad loans, Jaitley said the discussions centred around empowerment of banks, protection for bona fide decisions taken on commercial consideration and finding a resolution or taking solution-oriented steps.

Minister of State for Finance Jayant Sinha said the review meeting discussed ways to expedite and strengthen the recovery and resolution process.

“We are considering a stressed asset fund as well. That is something that the banks are also working on and we will certainly see what we can do in terms of solution to expedite the recovery process,” Sinha added.

IDBI Bank MD Kishor Kharat said the meeting discussed resolution mechanism wherein decisions of the bankers can be protected.

“In today’s atmosphere any decision taken by bankers, which is actually in the interest of recovery, if that is subsequently questioned then it becomes difficult to take a decision. Therefore, some buffer needs to be provided,” Kharat said.

Jaitley said the government is fully committed to supporting the banks to deal with the NPA situation and the Bankruptcy and Insolvency Code will become operational soon.

“Another set of amendments to the debt recovery legislation and the securitisation legislation are before Parliament. The joint committee is considering them…We hope to further empower the banks (to deal with NPAs),” he said. Jaitley said NPAs have risen on account of certain sectoral stress and the PSBs need to be supported fully so that their ability to extend credit and support growth remains sound.

On the issue of recapitalisation of banks, Jaitley said the government has already committed Rs 25,000 crore in the budget and “if more funds are required, we will make them available. (PTI)

Earlier in the day, Power Minister Piyush Goyal took stock of the progress of UDAY scheme, meant for the revival of discoms.

The meeting also reviewed the progress of financial inclusion schemes like Stand-up India and Mudra, credit flow to the industry. (PTI)