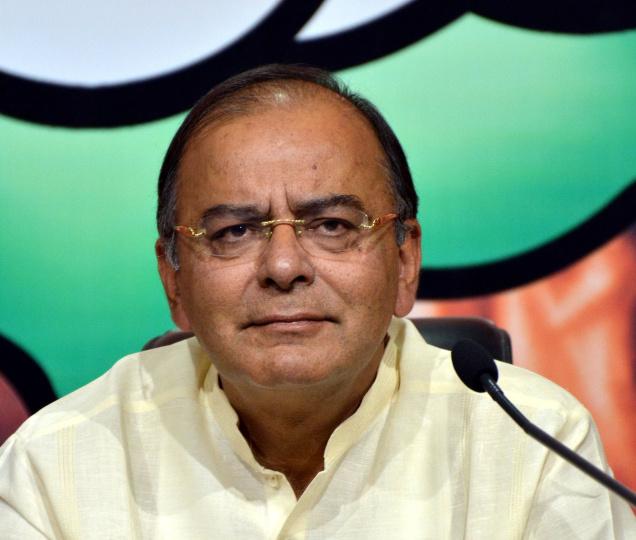

NEW DELHI: Already the fastest growing major economy in the world, India can grow at an even faster pace this year if predictions of good monsoon hold up, Finance Minister Arun Jaitley said today.

Replying to a debate on the Finance Bill 2016 which was later passed in the Lok Sabha, Jaitley ruled out rollback of one per cent excise on non-silver jewellery saying the levy was not applicable on small traders and artisans and only jewellers with more than Rs 12 crore turnover will attract the duty.

“I have not been able to understand the politics of hatred for ‘suit’ but love for gold,” he said as he took potshots at Congress which is opposing the levy of excise duty on gold and other previous jewellery.

If the Congress had objections to the levy, it can begin by removing the 5 per cent VAT on bullion in Kerala where it rules, he said.

Jaitley, who moved some amendments to the Finance Bill introduced by him on February 28 along with demands for grants and appropriation bill, listed out measures taken by the BJP government in last two years to give relief to small tax payers and reduce tax litigation.

On blackmoney, he said government efforts have brought to the books Rs 71,000 crore of undisclosed assets.

He however ruled out bringing agriculture income under the tax net, saying large farm-based income was rare and people using agriculture as front to hide income from other sources would be dealt with tax authorities.

The Bill, which is the penultimate part of the budget exercise, was passed with the amendments by voice vote.

While the global outlook remains bleak, Jaitley said India remains the fastest growing major economy in the world. “But we recognise we have the potential to grow at an even faster pace,” he said.

After two years of drought, if forecast of better monsoon rains this year holds good, it will improve agriculture and raise rural income, he said. “Economy which had been expanding on strength of public investment, highest foreign direct investment (FDI) and urban demand, can grow faster if rural demand is added,” he said.

Indian economy grew by 7.6 per cent in 2015-16 and is projected to grow by 7.5 per cent in the current year. Latest forecasts predict above-average rainfall in India after two years of drought.

A good monsoon season will help farm output of the world’s second-biggest producer of rice, wheat, sugar and cotton, Jaitley said.

On blackmoney, he said the government had last year brought a law for holders of undeclared foreign assets to come clean by paying tax along with interest and penalty.

While the HSBC list yielded Rs 6,500 crore of unassessed income, Rs 4000-4,250 crore has come to light from the foreign blackmoney law, he said.

Besides, direct and indirect measures have led to Rs 71,000 crore of black money last year, he said.

On the Panama paper leak, he said tax notices have gone to all the names of those holding offshore accounts that have been disclosed and action will be taken against those illegally parking money abroad.

Jaitley attacked the 1997 voluntary disclosure of income scheme (VDIS) as the “most ill-advised” as it allowed undeclared asset holders to pay just 30 per cent tax without any penalty or interest on 1987 value of gold and jewelery.

“It was an amnesty scheme,” he said, adding no cash came into system and most declarants were women and minor.

The scheme saw declarations of Rs 33,000 crore and about Rs 9,700 crore of tax paid but it was “unfair” on honest tax payers as it allowed dishonest ones to pay tax at rupee value of 1987, he said.

VDIS was challenged in Supreme Court as tax evaders were being given the facility of paying tax at 1987 value in 1997.

“If you honestly pay your taxes, you will pay at current value but if not, you will pay at 10 year old rupee value. This scheme could have been struck down as discrimination against honest tax payer but for the fact that the then government gave assurance to the Court that no future amnesty scheme would be brought,” he said.

Jaitley said the Budget for 2016-17 has provided for a scheme to deal with domestic blackmoney where undeclared assets can be brought to book by paying 30 per cent tax and an equivalent amount of penalty.

To settle disputes, the Budget proposed 45 per cent tax instead of regular 30 per cent for income that may have escaped assessment. Also, to companies facing retrospective taxation, an option has been given to them to pay principal amount and interest and penalty would be foregone.

The Minister said this year 33 taxation officers including 7 Group A were compulsorily retired and some including 6 Group A officers dismissed.

“Discretion of officers is not only being reduced but action also taken against them,” he said.

The range of penalty in hands of assessing officers has been reduced from 100 to 300 per cent of the undeclared income to 50 to 200 per cent, the lower limit being for unreporting and the higher one for deliberate attempt to hide income.

“Tax GDP ratio is low because we have to get people into the culture of paying taxation,” Jaitley said.

On his last year’s proposal to bring down corporate tax rate to 25 per cent in phases, Jaitley said he had linked it to phasing out of exemptions. “This year nothing has been phased out” so the tax remains at 30 per cent, he said.

But, a flat 25 per cent tax rate is provided for new manufacturing units that claim no exemption.

The Finance Minister said there was no move by the Centre to tax agriculture income because the sector is under stress.

“Category of people earning crores from agriculture is very little,” he said, adding though states had powers to levy tax on agriculture he would advise them not to levy it.

On excise duty on non-silver jewellery, he said the government was committed to reducing harassment of jewellers and so there is no tax on job workers.

The 1 per cent levy on non-silver articles would be only for jewellers with Rs 12 crore turnover and not small traders, he said adding if the Congress was so concerned about the levy it could advise the states ruled by it to remove VAT on gold.

The previous UPA government, he said, had in 2013 brought in a 80:20 scheme after current account deficit (CAD) ballooned to 4.5 per cent of GDP. Most of the CAD was becuase of gold imports for which Rs 2.5 lakh crore of foreign exchange was spent annually.

“Your government made law that only those people can import gold who can export 20 per cent out of it,” he said adding no small jeweller exported gold.

Also, between May 16, 2014 when the Lok Sabha election results were announced and May 26, 2014 when the new government took oath, certain trading houses were allowed to import gold, he said, adding that higher customs duty was not an answer as it would lead to more smuggling.

Jaitley said the global economy was earlier estimated to expand by 3.4 per cent but now it is projected to grow by 3.1 per cent. “It may be lesser than even that.”

Asian economies which had done better on strength of India and China, were previously projected to grow at 5.9 per cent but now they are projected to expand by 5.7 per cent.

China grew by 6.5 per cent last year and 6.7 per cent in first quarter while India posted growth of 7.6 per cent in 2015-16. “Their weight increases Asian growth,” he said.

Global economic outlook was a serious issue because it cannot be predicted how long the current slump in oil and commodity prices will last, the Finance Minister said, adding that the weak global outlook had impacted sectors like steel and contributed to the bad loan or NPA problem of banks.

“NPA issue with banks is an issue of concern. Some loans may have been given wrongly. I am not going into who is responsible for it. But weakened business cycle due to global economy has also impacted bank balance sheets,” he said.

Stating that woes of steel sector were because of it not being able to compete with China which is selling below cost, Jaitley said the government has taken number of steps like fixing a minimum threshold price for import and anti-dumping duties.

These have resulted in revival of steel mills and the sector was turning around, he said, adding that stalled highway projects have also being revived.

Also, steps to aid sugar mills as well as state electricity distribution companies will help address stressed assets.

“Hiding NPA will not resolve the problem. It should be reflected in balance sheet and addressed through capitalisation,” he said.

Jaitley said in the last fiscal, government spending had exceeded budget estimates and this year a record expenditure has been proposed.

To aid Make-in-India, changes in indirect tax proposals by way of rationalisation of customs duty and CVD are aimed to support domestic industry.

The housing sector has been given rebate while relief has been given to start-ups as well.

“Slowly corporate tax will be rationalised to bring them at level of globally competitive economies,” he said.

Observing that tax department was often seen as harassing tax payers, Jaitley said the interface has been minimised with electronic filing, assessment and refunds.

In 2015-16, 94 per cent of assessment was done through electronic mode and 2.10 crore refund totalling Rs 1.22 crore were sent electronically, he said adding more than 15,000 tax ligitations have been withdrawn.

Listing relief provided to small tax payers, he said the BJP government has raised exemption limit from Rs 1 lakh to Rs 1.5 lakh and an additional relief of Rs 50,000 is provided if the sum is invested in national pension scheme.

Also, tax relief for interest on home loans has been raised to Rs 1.5 lakh, while for first time, home buyers have been provided an additional Rs 50,000 exemption. Deduction for tax payers with up to 5 lakh income has been raised from Rs 2000 to Rs 5000.

Health insurance limit has been raised as also house rent allowance relief hiked to Rs 60,000 per year.

“These are instruments that tax base remains intact and relief is given to small taxpayers,” he said.

Jaitley said in the Budget for 2016-17, a new chapter of presumptive income has been added that provide professionals and small traders with annual income of up to Rs 50 lakh and Rs 2 crore turnover respectively to pay tax on an assumed income basis without maintaining any books.

States, he said, will get 42 per cent of the taxes from the central pool besides their own collections after the implementation of 14th Finance Commission recommendations.

Stating that there are some states like those in North East, hilly states, West Bengal and Kerala who have revenue deficit, he said Andhra Pradesh is facing problem after Hyderabad went to Telengana following bifurcation.

The undivided state of Andhra Pradesh got Rs 98,920 crore over five years under the 13th Finance Commission. The bifurcation meant Andhra Pradesh would have got 52 per cent of that and Telengana the remaining 48 per cent. Andhra’s share thus came to Rs 50,000 crore for five years or about Rs 10,000 crore a year.

As Andhra has to start afresh, build a capital and institutions, the Centre is extending all possible assistance and has provided for central institutions in the state, he said.

Under 14th Finance Commission, its share of central taxation shot up to Rs 14,100 crore. In 2015-16, it got Rs 21,900 crore, he said adding there is a revenue deficit of Rs 6,609 crore.

Of this, Rs 2,800 crore has been given so far, all subsequent years revenue deficit is to be paid each year. (PTI)

Trending Now

E-Paper