Are you planning an overseas vacation this year? Exciting! However, heavy foreign transaction fees and exchange rates can affect your travel budget.

Luckily, prepaid travel cards allow you to lock in favourable exchange rates and avoid costly fees compared to typical bank cards.

This post will explain how prepaid cards work, their major benefits, supported currencies, and tips for finding the best card for your next international adventure.

How Do Prepaid Travel Cards Work?

Prepaid travel cards function like regular debit cards – only preloaded with foreign currency funds rather than linked to a bank account. You can load multiple currencies onto a prepaid card ahead of your trip through the provider’s website or mobile app. Just determine which currencies you’ll need based on the countries you’re visiting.

As you travel, simply use the card to pay and withdraw cash abroad as a credit or debit card. The purchase amount is automatically deducted from your prepaid balance in the local currency.

Behind the scenes, your home currency is converted to foreign currency at the locked-in prepaid exchange rate rather than the bank’s rate. This means more money stays in your pocket!

When used properly, prepaid travel cards allow total control over exchange rates and eliminate foreign transaction fees levied by banks – with typical savings of 5-8%.

Major Advantages of Prepaid Travel Cards

Locked-In Exchange Rates

Banks use daily exchange rates from the volatile spot market that fluctuate over time – usually not in your favour. Prepaid providers lock in set rates from the more stable forward market when you load the card, protecting your purchasing power against shifts across these different types of foreign exchange markets.

No Foreign Transaction Fees

Most credit cards charge a 2-3% fee on all international purchases. Prepaid cards dodge this, instantly giving you 2-3% extra savings overseas.

Chip & PIN Security

Prepaid cards come with an EMV smart chip and PIN code for enhanced security at cash machines and payment terminals abroad.

Spending Limits & Controls

You can only spend the amount you preload onto prepaid cards. Set detailed notifications and limits to avoid overspending on impulse purchases or fraud.

Backup Funds On The Go

If you use up one of your loaded currencies, simply reload it via the mobile app without carrying cash everywhere as a backup.

What Currencies Can You Spend With a Prepaid Card?

Most prepaid card providers allow you to hold numerous currencies on a single card – typically 8-15 major world currencies.

The most universally supported currencies include:

- Euro (EUR)

- British Pound Sterling (GBP)

- US Dollar (USD)

- Australian Dollar (AUD)

- Canadian Dollar (CAD)

Browse each provider’s supported currencies before applying to ensure your destinations are covered. Most trips can be accommodated with 5-6 preloaded currencies.

Tips for Finding the Best Prepaid Travel Card

With dozens of providers available, finding the right prepaid card takes a little research. Use these tips when comparing offerings:

Look for Favorable Exchange Rates

Compare exchange rates across vendors for your needed currencies. Every little bit counts when converting large purchase volumes. An extra 2% difference can equal hundreds in savings.

Check Fees Carefully

Avoid cards with loading, reloading, monthly, withdrawal, balance inquiry, currency conversion, and other nickel-and-dime fees that erode savings overseas. Watch for decent ATM access as well.

Read Fine Print on Limits

Understand maximum load amounts, swipe limits, withdrawal limits, supported merchant codes, countries where use is prohibited, and other fine print that creates headaches abroad if exceeded.

Weigh Refund & Fraud Protection

What happens if your prepaid card is lost, stolen or scammed while travelling? Compare fraud and loss protection across providers. Also, check refund policy timeframes and requirements.

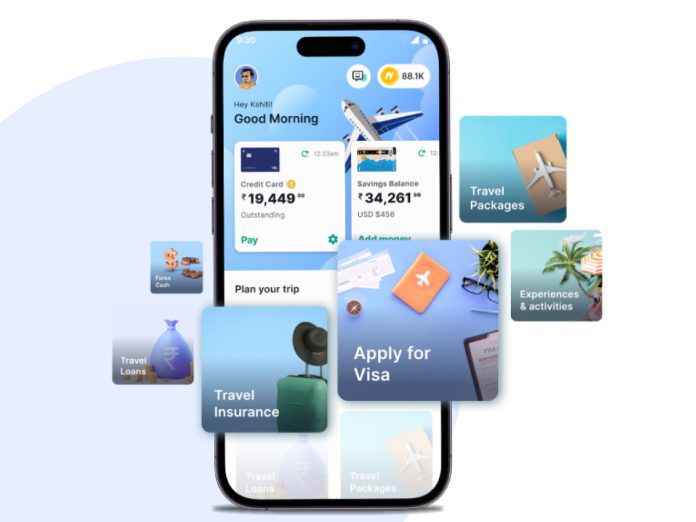

Check Mobile App Scores

You’ll rely heavily on the provider’s card management app overseas. Read reviews and confirm it offers necessary functions like instant reloads, transaction notifications, spending caps, etc. No app is a dealbreaker.

The Bottom Line

Using prepaid travel cards instead of typical bank cards, you can save 5-8% on overseas vacation spending through better exchange rates and zero foreign transaction fees. Just compare offerings across multiple vendors using the tips above first. Locking in favourable rates ahead of time sets you up to get the absolute most from your hard-earned travel budget.